Growing E-commerce Demand

The US Warehouse Robotics Market is experiencing a surge in demand driven by the rapid growth of e-commerce. As online shopping continues to gain traction, warehouses are under pressure to enhance their operational efficiency. In 2025, e-commerce sales in the US reached approximately 1 trillion USD, prompting companies to invest in automation solutions. Robotics technology, including automated guided vehicles and robotic picking systems, is being adopted to streamline order fulfillment processes. This trend is likely to persist, as businesses seek to meet consumer expectations for faster delivery times and improved service levels. Consequently, the integration of robotics in warehouses is becoming a strategic imperative for companies aiming to remain competitive in the evolving retail landscape.

Government Initiatives and Support

The US Warehouse Robotics Market is benefiting from various government initiatives aimed at promoting automation and technological innovation. Federal and state programs are increasingly providing funding and resources to support the adoption of robotics in warehouses. These initiatives are designed to enhance productivity, improve safety standards, and foster economic growth. For instance, the US Department of Commerce has launched programs to assist small and medium-sized enterprises in integrating advanced technologies. Such support is likely to encourage more businesses to invest in warehouse robotics, thereby accelerating the market's growth. As these initiatives gain traction, the landscape of the US Warehouse Robotics Market is expected to evolve significantly.

Technological Advancements in Robotics

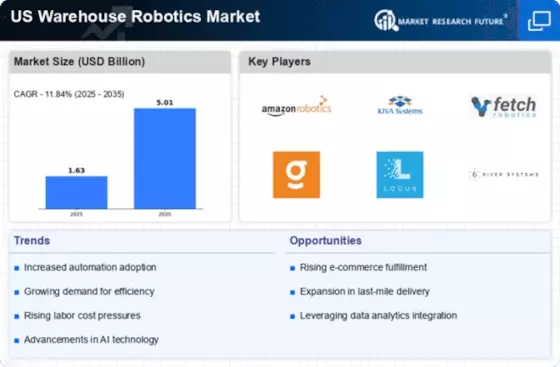

The US Warehouse Robotics Market is witnessing rapid technological advancements that are reshaping the landscape of warehouse operations. Innovations in robotics, such as improved sensors, machine learning algorithms, and enhanced navigation systems, are enabling more sophisticated automation solutions. These advancements allow for greater flexibility and adaptability in warehouse environments, facilitating the integration of robotics into existing workflows. As companies increasingly recognize the potential of these technologies, investments in robotic systems are expected to rise. In 2025, the market for warehouse robotics in the US was valued at approximately 5 billion USD, indicating a robust growth trajectory driven by technological innovation.

Rising Focus on Supply Chain Resilience

The US Warehouse Robotics Market is increasingly shaped by the growing emphasis on supply chain resilience. Companies are recognizing the need to enhance their operational capabilities to withstand disruptions and ensure continuity. Robotics technology plays a crucial role in achieving this goal by enabling more agile and responsive warehouse operations. The integration of automated systems allows for better inventory management, faster order processing, and improved overall efficiency. As businesses strive to build more resilient supply chains, investments in warehouse robotics are anticipated to rise. This trend is likely to drive the market forward, as organizations seek to leverage technology to navigate uncertainties and enhance their competitive edge.

Labor Shortages and Workforce Challenges

The US Warehouse Robotics Market is significantly influenced by ongoing labor shortages across various sectors. The logistics and warehousing industries are particularly affected, with many companies struggling to find skilled labor. In response, organizations are increasingly turning to robotics to mitigate the impact of these workforce challenges. The introduction of automated systems not only addresses labor shortages but also enhances productivity and operational efficiency. According to recent data, the US logistics sector is projected to face a shortfall of over 1 million workers by 2027. This alarming trend underscores the necessity for automation, as businesses seek to maintain their output levels and meet growing consumer demands.