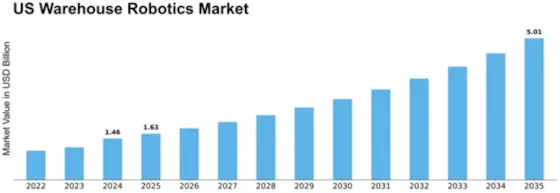

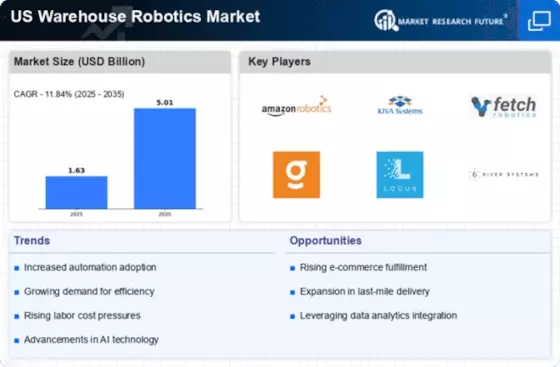

Us Warehouse Robotics Size

US Warehouse Robotics Market Growth Projections and Opportunities

The US warehouse robotics market is undergoing a transformative phase, driven by a confluence of market factors that collectively shape its trajectory. One of the primary catalysts for this evolution is the escalating demand for efficiency and speed in logistics and supply chain operations. As e-commerce continues to burgeon, fueled by changing consumer habits and a surge in online shopping, companies are increasingly turning to warehouse robotics to streamline their processes. The need for swift order fulfillment, coupled with the desire to reduce operational costs, has become a driving force behind the adoption of robotic solutions in warehouses across the United States.

Technological advancements represent another pivotal factor influencing the warehouse robotics market. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and computer vision has significantly enhanced the capabilities of warehouse robots. These innovations enable robots to navigate complex warehouse environments, optimize inventory management, and execute intricate tasks with precision. As the technology matures, the cost-effectiveness of implementing robotic solutions increases, making them more accessible to a broader spectrum of businesses.

Furthermore, the ongoing labor challenges within the logistics industry contribute to the increasing reliance on warehouse robotics. With a growing demand for skilled labor and a simultaneous shortage of qualified workers, companies are turning to automation to address these workforce constraints. Warehouse robots not only fill the gaps in labor but also contribute to a safer working environment by handling repetitive and physically demanding tasks, allowing human workers to focus on more complex and value-added responsibilities.

The competitive landscape is another critical market factor shaping the trajectory of warehouse robotics in the US. As more companies recognize the benefits of automation, there is a heightened emphasis on innovation and product development among manufacturers and solution providers. This competition fosters the creation of more sophisticated and specialized robotic solutions tailored to meet the diverse needs of different industries. As a result, the market experiences a continual influx of new and improved robotic technologies.

Government initiatives and regulations also play a role in steering the warehouse robotics market. Policies that promote the adoption of automation, such as tax incentives or subsidies, can incentivize businesses to invest in robotic solutions. Conversely, regulations regarding safety standards and ethical considerations in the use of robotics can influence the pace and direction of market growth. Striking a balance between innovation and ethical practices becomes paramount as the industry navigates through regulatory landscapes.

In addition to these factors, the COVID-19 pandemic has accelerated the adoption of warehouse robotics. The disruptions caused by the global health crisis highlighted the vulnerability of traditional supply chain models. To mitigate future risks and enhance resilience, businesses are increasingly incorporating robotics into their supply chain strategies. The pandemic has acted as a catalyst, propelling the warehouse robotics market into the spotlight as a strategic investment for future-proofing supply chain operations.

Leave a Comment