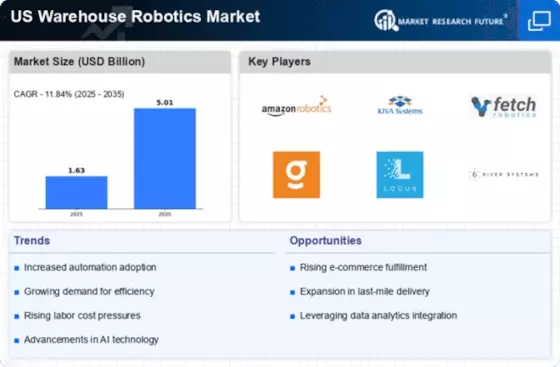

Top Industry Leaders in the US Warehouse Robotics Market

The Competitive Landscape of US Warehouse Robotics Market

In the symphony of security, where vigilance plays the melody and prevention harmonizes with response, Perimeter Intrusion Detection Systems (PIDS) act as the watchful conductor, safeguarding critical infrastructure and assets from unauthorized intrusions. This dynamic market pulsates with innovation, fierce competition, and the promise of safeguarding sensitive assets against ever-evolving threats. Navigating this intricate space requires discerning the strategies of key players, understanding market share nuances, and recognizing the emerging trends shaping its future security symphony.

Key Player:

- ABB

- Bastian Solutions LLC

- Daifuku Co. Ltd.

- Dematic

- Fetch Robotics Inc.

- Honeywell International Inc.

- KNAPP AG

- KUKA AG

- OMRON Corporation

- YASKAWA Electric Corporation

- FANUC Corporation

Strategies Adopted by Leaders:

- Technology Prowess: Amazon Robotics leads the charge with advanced robot designs, sophisticated software algorithms for path planning and coordination, and seamless integration with existing warehouse management systems.

- Vertical Specialization: Fetch Robotics focuses on smaller warehouses and e-commerce fulfillment with agile robots, while Honeywell Intelligrated caters to large-scale logistics centers with automated storage and retrieval systems (ASRS).

- Partnership Play: Boston Dynamics collaborates with leading logistics providers and system integrators, offering its advanced humanoid robots for specific tasks like pallet handling and package inspection.

- Open-Source Platforms: The Robot Operating System (ROS) community promotes open-source software tools for robot development and control, lowering entry barriers and empowering smaller players.

- Focus on User Experience and Ease of Use: Intuitive interfaces, drag-and-drop robot programming tools, and remote monitoring capabilities enhance usability and reduce reliance on specialized tech personnel.

Factors for Market Share Analysis:

- Robot Capabilities and Versatility: Companies offering robots with high payload capacities, diverse movement capabilities, and adaptability to various warehouse tasks command premium prices and secure market share by delivering increased productivity and operational flexibility.

- Software Platform and Integration: Robust software platforms with advanced navigation algorithms, traffic management systems, and seamless integration with warehouse management systems (WMS) and enterprise resource planning (ERP) systems are crucial for efficient workflows and data visibility.

- Deployment and Implementation Services: Providing comprehensive support, from initial site surveys and system design to installation, training, and ongoing maintenance, is essential for successful implementation and customer satisfaction.

- Scalability and Adaptability: Robotic solutions that can be easily scaled to meet changing warehouse needs and adapt to different product sizes and storage configurations are valuable for future growth and flexibility.

- Cost Competitiveness and ROI: Balancing advanced features with an attractive price point and demonstrating clear ROI through increased efficiency and labor cost reduction is crucial for capturing market share, particularly in price-sensitive segments.

New and Emerging Companies:

- Startups like Geek+ and Locus Robotics: These innovators focus on affordable, modular robot systems with plug-and-play functionality, catering to smaller warehouses and startups seeking cost-effective automation solutions.

- Academia and Research Labs: MIT's Computer Science and Artificial Intelligence Laboratory and Stanford University's Department of Aeronautics and Astronautics explore next-generation warehouse robotics technologies like collaborative robots and drone-based inventory management, shaping the future of the market.

- Software and App Developers: Companies like Vecna Robotics and 6 River Technologies develop advanced software and analytics tools for warehouse robots, offering features like predictive maintenance, real-time optimization, and AI-powered decision support.

Industry Developments:

ABB:

- November 2023, Launched a new line of collaborative robots specifically designed for warehouse tasks like palletizing and kitting.

- July 2023, Partnered with a major logistics company to deploy their warehouse robotics solutions in multiple distribution centers.

Bastian Solutions LLC:

- October 2023, Introduced a new modular warehouse automation system combining AMRs, conveyor belts, and robotic arms for customized operations.

- June 2023, Acquired a startup specializing in AI-powered robot path planning software, strengthening their automation capabilities.