Cost Efficiency

Cost efficiency remains a pivotal driver in the Data Warehouse as a Service Market. Organizations are increasingly drawn to the subscription-based pricing models that these services offer, which can significantly lower upfront capital expenditures. By leveraging cloud-based data warehousing, companies can avoid the costs associated with maintaining on-premises infrastructure. According to recent estimates, businesses can save up to 30% on operational costs by migrating to a Data Warehouse as a Service Market model. This financial advantage is particularly appealing to small and medium-sized enterprises that may lack the resources for extensive IT investments. As the market evolves, the emphasis on cost-effective solutions is expected to propel the Data Warehouse as a Service Market forward.

Regulatory Compliance

Regulatory compliance is becoming an increasingly critical factor influencing the Data Warehouse as a Service Market. Organizations are required to adhere to various data protection regulations, such as GDPR and CCPA, which mandate stringent data management practices. As a result, businesses are turning to data warehousing solutions that not only ensure compliance but also provide robust security features. The ability to manage and protect sensitive data effectively is paramount, and data warehousing services that offer built-in compliance tools are likely to see heightened demand. This trend underscores the importance of regulatory considerations in shaping the Data Warehouse as a Service Market, as organizations prioritize solutions that mitigate compliance risks.

Scalability and Flexibility

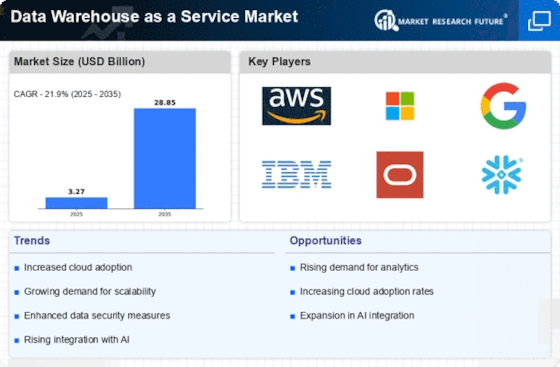

The Data Warehouse as a Service Market is experiencing a notable shift towards scalable and flexible solutions. Organizations are increasingly seeking data warehousing options that can grow with their needs, allowing for the seamless addition of resources as data volumes expand. This trend is underscored by the fact that the data generated worldwide is projected to reach 175 zettabytes by 2025, necessitating robust storage solutions. The ability to scale resources on-demand not only enhances operational efficiency but also reduces costs associated with over-provisioning. As businesses continue to embrace digital transformation, the demand for scalable data warehousing solutions is likely to rise, positioning the Data Warehouse as a Service Market for sustained growth.

Growing Data Volume and Variety

The exponential growth of data volume and variety is a significant driver in the Data Warehouse as a Service Market. With the proliferation of IoT devices, social media, and digital transactions, organizations are inundated with vast amounts of structured and unstructured data. This surge necessitates advanced data warehousing solutions capable of handling diverse data types and large volumes efficiently. It is estimated that by 2025, the amount of data created daily will reach 463 exabytes, further emphasizing the need for scalable and versatile data warehousing options. As businesses strive to leverage this data for competitive advantage, the Data Warehouse as a Service Market is poised for substantial growth, driven by the demand for solutions that can accommodate the complexities of modern data landscapes.

Integration with Advanced Technologies

The integration of advanced technologies is a key driver in the Data Warehouse as a Service Market. The rise of artificial intelligence, machine learning, and big data analytics is compelling organizations to adopt data warehousing solutions that can seamlessly integrate with these technologies. This integration facilitates enhanced data processing capabilities and allows for more sophisticated analytics, which are essential for informed decision-making. As businesses increasingly rely on data-driven insights, the demand for data warehousing solutions that support advanced analytics is likely to grow. The Data Warehouse as a Service Market is thus positioned to benefit from this trend, as organizations seek to harness the power of their data more effectively.