Market Trends

Key Emerging Trends in the US Warehouse Robotics Market

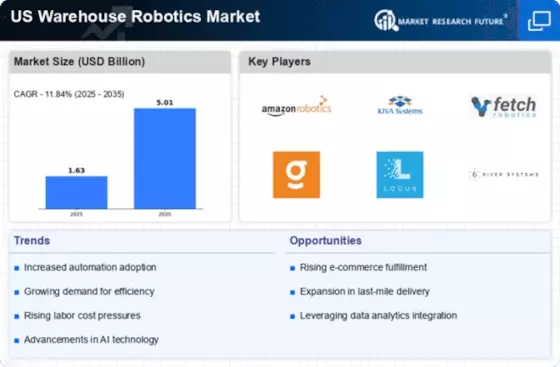

The US warehouse robotics market is undergoing a transformative phase, marked by robust market trends that reflect the evolving dynamics of the industry. With the increasing demand for efficiency, speed, and accuracy in supply chain operations, warehouse robotics has emerged as a pivotal solution, reshaping the landscape of logistics and distribution. One of the prominent trends in this market is the growing adoption of autonomous mobile robots (AMRs). These robots, equipped with advanced navigation and sensing technologies, are adept at navigating through warehouse environments, transporting goods, and collaborating seamlessly with human workers.

Another key trend driving the US warehouse robotics market is the integration of artificial intelligence (AI) and machine learning (ML) algorithms. These technologies empower robots to analyze and process vast amounts of data, optimizing their performance and decision-making capabilities. As a result, warehouse robots can adapt to changing circumstances, anticipate demand patterns, and enhance overall operational efficiency. The implementation of AI and ML is not only streamlining routine tasks but also enabling robots to learn and improve their functionality over time, making them indispensable assets in the rapidly evolving logistics landscape.

Collaborative robots, or cobots, are gaining traction in the US warehouse robotics market as well. These robots are designed to work alongside human operators, enhancing productivity and efficiency in warehouse tasks. Cobots are equipped with advanced safety features, allowing them to operate in close proximity to humans without posing a threat. This collaborative approach ensures that robots and human workers can complement each other's strengths, leading to a more flexible and adaptive warehouse ecosystem.

E-commerce growth is a major driver influencing the market trends of US warehouse robotics. The surge in online shopping has spurred the demand for fast and accurate order fulfillment. Warehouse robots play a pivotal role in meeting this demand by automating order picking, packing, and shipping processes. The ability of robots to work tirelessly and consistently in a 24/7 environment ensures that warehouses can keep up with the increasing volume of e-commerce orders, reducing lead times and enhancing customer satisfaction.

Furthermore, there is a noticeable trend towards modular and scalable robotics solutions in the US warehouse market. Businesses are looking for adaptable systems that can be easily integrated into existing operations and scaled up or down based on demand. Modular robotics solutions offer flexibility and cost-effectiveness, allowing warehouses to tailor their automation strategies to specific needs without major overhauls or disruptions to their existing workflows.

While the US warehouse robotics market is witnessing rapid growth, challenges such as high initial costs and concerns about job displacement remain. However, the long-term benefits in terms of increased efficiency, accuracy, and overall operational optimization are compelling factors that are driving widespread adoption. As technology continues to advance, and the robotics industry matures, the US warehouse robotics market is poised to play a pivotal role in shaping the future of logistics and supply chain management. The integration of cutting-edge technologies and the continued emphasis on collaboration between humans and robots underscore a promising trajectory for the warehouse robotics sector in the United States.

Leave a Comment