Rising E-commerce Demand

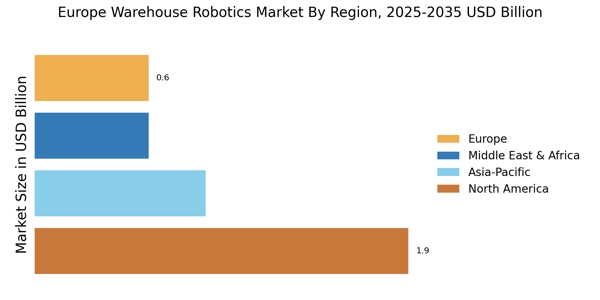

The surge in e-commerce activities across Europe is a pivotal driver for the Europe Warehouse Robotics Market. As online shopping continues to gain traction, logistics and warehousing operations are compelled to enhance their efficiency and speed. According to recent data, the European e-commerce market is projected to reach approximately 800 billion euros by 2026. This growth necessitates the adoption of advanced robotics solutions to manage increased order volumes and streamline operations. Warehouse robotics, including automated guided vehicles and robotic picking systems, are becoming essential to meet consumer expectations for rapid delivery. Consequently, the demand for warehouse robotics is likely to escalate, as companies seek to optimize their supply chains and reduce operational costs.

Focus on Supply Chain Resilience

The emphasis on supply chain resilience is increasingly influencing the Europe Warehouse Robotics Market. Recent disruptions in global supply chains have highlighted the need for businesses to enhance their operational flexibility and responsiveness. Companies are now prioritizing investments in warehouse robotics to build more resilient supply chains capable of adapting to unforeseen challenges. The European logistics sector is projected to invest over 10 billion euros in automation technologies by 2026, reflecting this shift in focus. By integrating robotics into their operations, businesses can improve inventory management, reduce lead times, and enhance overall supply chain efficiency, thereby positioning themselves to better withstand future disruptions.

Government Initiatives and Funding

Government initiatives and funding programs are playing a crucial role in the growth of the Europe Warehouse Robotics Market. Various European governments are actively promoting automation and robotics through grants, subsidies, and research funding. For example, the European Union has launched several initiatives aimed at fostering innovation in robotics, which includes financial support for companies adopting advanced technologies. This support not only encourages businesses to invest in warehouse robotics but also helps to create a favorable regulatory environment for their deployment. As a result, the market for warehouse robotics is expected to expand, driven by both public and private sector investments in automation technologies.

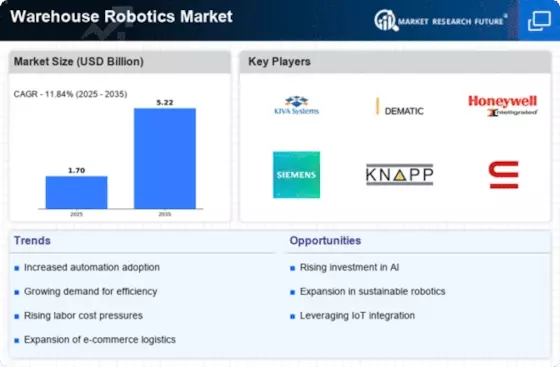

Technological Advancements in Robotics

Technological advancements are significantly shaping the Europe Warehouse Robotics Market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of warehouse robots, making them more efficient and versatile. For instance, the integration of AI allows robots to learn from their environment and optimize their operations in real-time. The European robotics sector is expected to grow at a compound annual growth rate of around 12% over the next five years, driven by these technological improvements. As companies seek to leverage these advancements, the demand for sophisticated robotic solutions in warehouses is likely to increase, enabling businesses to improve their operational efficiency and reduce costs.

Labor Shortages and Workforce Challenges

Labor shortages in Europe are increasingly influencing the dynamics of the Europe Warehouse Robotics Market. Many sectors, particularly logistics and warehousing, are facing difficulties in attracting and retaining skilled labor. This challenge is prompting companies to invest in automation technologies, including robotics, to mitigate the impact of workforce shortages. The European Commission has reported that labor shortages could reach 2 million by 2025 in various industries. As a result, warehouse robotics are being viewed as a viable solution to enhance productivity and maintain operational continuity. By integrating robotic systems, companies can alleviate the pressure on human resources while ensuring that their operations remain efficient and responsive to market demands.