Rising E-commerce Sector

The Global Warehouse Robotics and Automation Market Industry is significantly impacted by the rapid growth of the e-commerce sector. As online shopping continues to gain popularity, warehouses are under pressure to fulfill orders quickly and accurately. Automation technologies, such as robotic picking systems and automated sorting solutions, are being implemented to meet these demands. This trend is evident in major e-commerce companies that are investing heavily in robotic systems to enhance their logistics capabilities. The increasing volume of online orders is expected to drive further growth in the market, aligning with the projected expansion of the industry.

Increased Demand for Efficiency

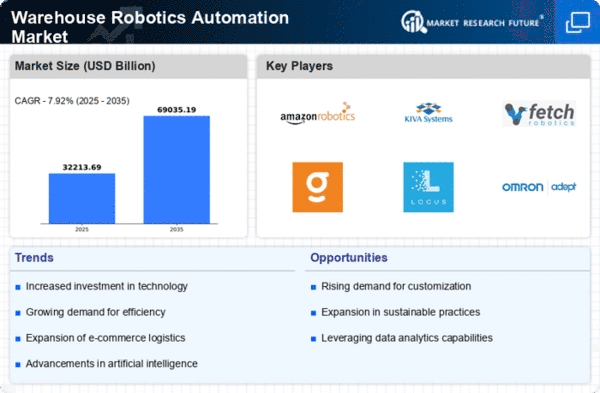

The Global Warehouse Robotics and Automation Market Industry is experiencing heightened demand for efficiency in logistics and supply chain operations. Companies are increasingly adopting robotic solutions to streamline processes, reduce labor costs, and enhance productivity. For instance, automated guided vehicles (AGVs) are being utilized to transport goods within warehouses, significantly decreasing operational time. In 2024, the market is valued at 3.76 USD Billion, reflecting a growing trend towards automation. This shift is likely to continue as businesses seek to optimize their operations and respond to consumer demands more effectively.

Technological Advancements in Robotics

Technological advancements are a driving force in the Global Warehouse Robotics and Automation Market Industry. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of warehouse robots. These advancements enable robots to navigate complex environments, make real-time decisions, and interact safely with human workers. As these technologies evolve, they are likely to become more accessible and affordable for businesses of all sizes. The anticipated compound annual growth rate (CAGR) of 18.79% from 2025 to 2035 indicates a robust future for the industry, as companies increasingly invest in cutting-edge automation solutions.

Labor Shortages and Workforce Challenges

The Global Warehouse Robotics and Automation Market Industry is significantly influenced by ongoing labor shortages. Many sectors face difficulties in recruiting and retaining skilled workers, prompting companies to turn to automation as a viable solution. Robotics can perform repetitive tasks, allowing human workers to focus on more complex roles. This trend is particularly evident in regions with declining workforce numbers. As a result, the market is projected to grow substantially, with estimates suggesting it could reach 25 USD Billion by 2035. This shift underscores the necessity for businesses to adapt to changing labor dynamics.

Sustainability and Environmental Considerations

Sustainability is becoming a crucial factor in the Global Warehouse Robotics and Automation Market Industry. Companies are increasingly recognizing the importance of reducing their carbon footprint and improving energy efficiency. Automation technologies can contribute to these goals by optimizing resource use and minimizing waste. For example, automated systems can reduce energy consumption through efficient routing and scheduling. As businesses strive to meet sustainability targets, the demand for robotic solutions that support these initiatives is likely to rise. This focus on environmental responsibility may further propel the growth of the market in the coming years.