Rising E-commerce Demand

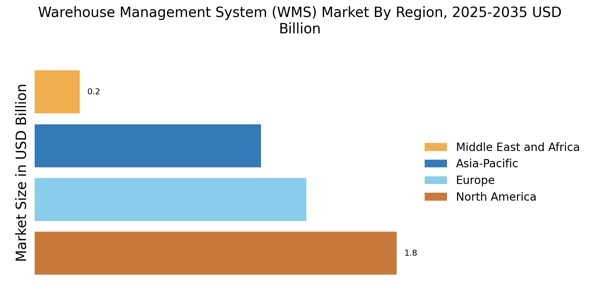

The surge in e-commerce activities has catalyzed the Warehouse Management System (WMS) Market, as businesses seek to optimize their supply chains. With online retail sales projected to reach trillions in the coming years, the need for efficient inventory management and order fulfillment has never been more critical. Companies are increasingly adopting WMS solutions to enhance their operational efficiency, reduce lead times, and improve customer satisfaction. This trend is particularly evident in sectors such as consumer electronics and fashion, where rapid order processing is essential. As e-commerce continues to expand, the Warehouse Management System (WMS) Market is likely to experience sustained growth, driven by the necessity for advanced logistics capabilities.

Emphasis on Data Analytics

The emphasis on data analytics is transforming the Warehouse Management System (WMS) Market, as organizations seek to harness the power of data for informed decision-making. Advanced WMS solutions now incorporate analytics capabilities that allow businesses to gain insights into inventory levels, order patterns, and operational performance. This data-driven approach enables companies to optimize their warehouse operations, forecast demand more accurately, and enhance overall efficiency. Market Research Future indicates that organizations leveraging data analytics within their WMS can improve inventory turnover rates by up to 25%. As the importance of data continues to grow, the Warehouse Management System (WMS) Market is likely to evolve, with analytics becoming a core component of WMS solutions.

Technological Advancements

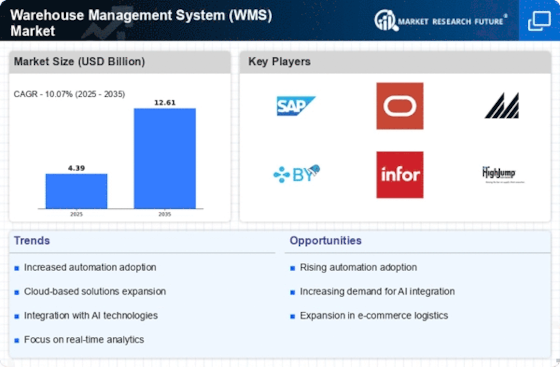

The Warehouse Management System (WMS) Market is significantly influenced by ongoing technological advancements. Innovations such as cloud computing, Internet of Things (IoT), and mobile technologies are reshaping how warehouses operate. For instance, the integration of IoT devices allows for real-time tracking of inventory, which enhances visibility and accuracy in stock management. Furthermore, cloud-based WMS solutions are becoming increasingly popular due to their scalability and cost-effectiveness. According to recent data, the adoption of cloud-based WMS is expected to grow at a compound annual growth rate of over 15% in the next few years. This technological evolution is likely to drive the Warehouse Management System (WMS) Market towards greater efficiency and flexibility.

Increased Regulatory Compliance

The Warehouse Management System (WMS) Market is also shaped by the growing need for regulatory compliance across various sectors. As industries face stricter regulations regarding inventory management, safety standards, and traceability, the demand for robust WMS solutions is on the rise. Companies are increasingly adopting WMS to ensure compliance with regulations such as the Food Safety Modernization Act and other industry-specific guidelines. This trend is particularly pronounced in sectors like pharmaceuticals and food and beverage, where compliance is critical. The need for effective compliance management is likely to drive growth in the Warehouse Management System (WMS) Market, as organizations seek to mitigate risks associated with non-compliance.

Focus on Supply Chain Optimization

As businesses strive for operational excellence, the focus on supply chain optimization is becoming paramount within the Warehouse Management System (WMS) Market. Companies are recognizing that an efficient supply chain can lead to significant cost savings and improved service levels. The implementation of WMS solutions enables organizations to streamline their processes, reduce excess inventory, and enhance order accuracy. Market data suggests that companies utilizing advanced WMS can achieve up to a 30% reduction in operational costs. This emphasis on optimization is likely to propel the Warehouse Management System (WMS) Market forward, as more organizations seek to leverage technology for competitive advantage.