Infrastructure Development

The expansion of charging infrastructure across India is a crucial factor influencing the India Battery Management System Electric Vehicles Market. The government and private sector are investing heavily in establishing a widespread network of charging stations, which is essential for the growth of electric vehicles. As of 2025, India aims to have over 1,000 charging stations in major cities, facilitating easier access to charging for EV users. This infrastructure development not only encourages the adoption of electric vehicles but also necessitates advanced battery management systems to optimize charging processes and enhance battery life. The synergy between charging infrastructure and battery management systems is likely to create a more favorable environment for the growth of the India Battery Management System Electric Vehicles Market, as consumers will feel more confident in transitioning to electric mobility.

Consumer Awareness and Adoption

Increasing consumer awareness regarding environmental issues and the benefits of electric vehicles is a significant driver for the India Battery Management System Electric Vehicles Market. As more consumers become informed about the advantages of EVs, such as lower operating costs and reduced carbon emissions, the demand for electric vehicles is expected to rise. Surveys indicate that approximately 60% of Indian consumers are considering purchasing an electric vehicle in the next few years. This growing interest necessitates the development of efficient battery management systems to ensure optimal performance and longevity of EV batteries. The rising adoption of EVs is likely to create a robust market for battery management systems, as consumers seek reliable solutions that enhance their driving experience. Consequently, the India Battery Management System Electric Vehicles Market stands to benefit from this heightened consumer engagement.

Government Initiatives and Policies

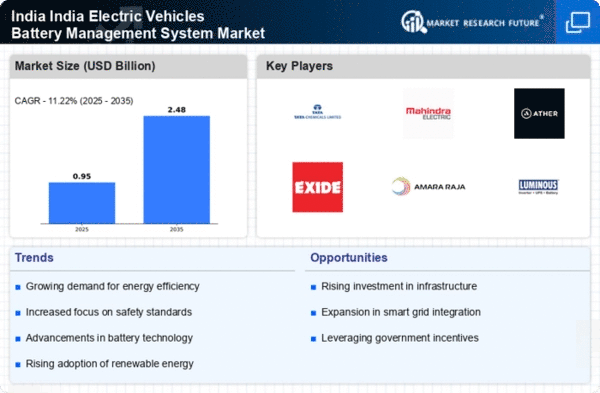

The Indian government has been actively promoting electric vehicles (EVs) through various initiatives and policies, which significantly bolster the India Battery Management System Electric Vehicles Market. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme aims to incentivize the adoption of EVs, thereby increasing the demand for efficient battery management systems. Additionally, the National Electric Mobility Mission Plan (NEMMP) outlines a roadmap for the growth of the EV sector, which includes the development of robust battery management systems. As of 2025, the Indian EV market is projected to reach approximately USD 150 billion, indicating a substantial opportunity for battery management systems to enhance performance and longevity of EV batteries. These government efforts are likely to create a conducive environment for the growth of the India Battery Management System Electric Vehicles Market.

Technological Advancements in Battery Management

Technological innovations in battery management systems are pivotal for the growth of the India Battery Management System Electric Vehicles Market. Recent advancements in battery chemistry, such as lithium-sulfur and solid-state batteries, promise higher energy densities and improved safety. Furthermore, the integration of artificial intelligence and machine learning in battery management systems allows for real-time monitoring and predictive maintenance, enhancing battery life and performance. As of 2025, the market for battery management systems in India is expected to grow at a compound annual growth rate (CAGR) of around 20%, driven by these technological advancements. This growth indicates a rising demand for sophisticated battery management solutions that can optimize the performance of electric vehicles, thereby reinforcing the importance of innovation in the India Battery Management System Electric Vehicles Market.

Environmental Regulations and Sustainability Goals

Stringent environmental regulations and sustainability goals set by the Indian government are driving the growth of the India Battery Management System Electric Vehicles Market. The government has committed to reducing greenhouse gas emissions and promoting sustainable transportation solutions. As part of this commitment, regulations are being implemented to encourage the adoption of electric vehicles, which in turn increases the demand for efficient battery management systems. The target of achieving 30% electric vehicle penetration by 2030 underscores the urgency for advanced battery management solutions that can support this transition. This regulatory framework not only fosters innovation in battery technology but also positions the India Battery Management System Electric Vehicles Market as a key player in the broader context of sustainable development.