Rising Fuel Prices

The electric vehicles-battery market is likely to benefit from the ongoing rise in fuel prices, which has prompted consumers to seek alternative transportation options. As gasoline prices fluctuate, many individuals are turning to electric vehicles as a cost-effective solution for their commuting needs. The average price of gasoline has seen significant increases, leading to a growing awareness of the long-term savings associated with electric vehicle ownership. This shift in consumer behavior is expected to drive demand for electric vehicles, consequently boosting the electric vehicles-battery market. Furthermore, as more consumers recognize the potential for reduced operating costs, the market may witness an accelerated transition towards electric mobility.

Consumer Awareness and Education

The electric vehicles-battery market is benefiting from increased consumer awareness and education regarding the advantages of electric vehicles. As more information becomes available about the environmental benefits, cost savings, and technological advancements associated with electric vehicles, consumers are becoming more inclined to consider them as viable alternatives to traditional vehicles. Educational campaigns and outreach programs are playing a crucial role in dispelling myths and providing accurate information about electric vehicle ownership. This growing awareness is likely to translate into higher demand for electric vehicles, thereby positively impacting the electric vehicles-battery market. As consumers become more informed, the market may witness a shift in preferences towards electric mobility.

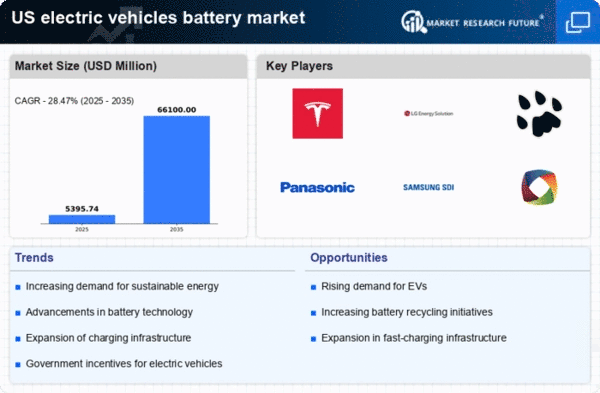

Advancements in Battery Technology

The electric vehicles-battery market is poised for growth due to ongoing advancements in battery technology. Innovations such as solid-state batteries and improvements in lithium-ion technology are enhancing energy density, reducing charging times, and increasing overall battery lifespan. These technological improvements are crucial for addressing consumer concerns regarding range anxiety and charging infrastructure. For example, the development of batteries with higher energy densities could enable electric vehicles to travel longer distances on a single charge, making them more appealing to a broader audience. As manufacturers continue to invest in research and development, the electric vehicles-battery market is likely to see a proliferation of more efficient and reliable battery solutions.

Government Incentives and Subsidies

The electric vehicles-battery market is experiencing a surge in growth due to various government incentives and subsidies aimed at promoting electric vehicle adoption. Federal and state governments are offering tax credits, rebates, and grants to consumers and manufacturers, which can significantly reduce the overall cost of electric vehicles. For instance, the federal tax credit can reach up to $7,500 for eligible electric vehicles, making them more financially accessible. Additionally, states like California have implemented their own incentives, further stimulating demand. This financial support not only encourages consumers to purchase electric vehicles but also incentivizes manufacturers to invest in battery technology and production, thereby enhancing the electric vehicles-battery market's growth trajectory.

Environmental Regulations and Standards

The electric vehicles-battery market is significantly influenced by stringent environmental regulations and standards aimed at reducing greenhouse gas emissions. Governments are implementing policies that mandate lower emissions from vehicles, which is driving the shift towards electric mobility. For instance, California has set ambitious targets for reducing emissions, which has led to increased investments in electric vehicle technology and infrastructure. These regulations not only encourage consumers to adopt electric vehicles but also compel manufacturers to innovate and produce cleaner battery technologies. As a result, the electric vehicles-battery market is expected to expand as compliance with these regulations becomes a priority for automakers.