Rising Demand for Electric Vehicles

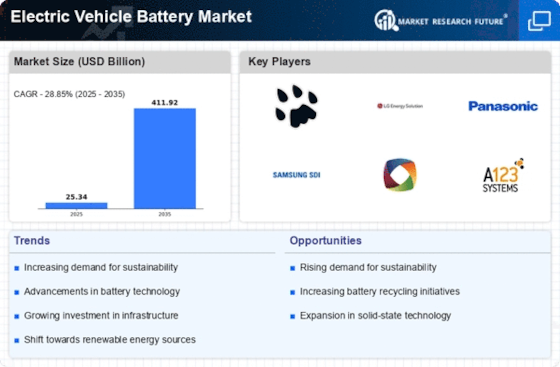

The increasing consumer preference for electric vehicles is a primary driver of the Electric Vehicle Battery Market. As more individuals seek sustainable transportation options, the demand for electric vehicles continues to rise. In 2025, it is estimated that electric vehicle sales will account for approximately 30% of total vehicle sales. This surge in demand directly correlates with the need for advanced battery technologies, as manufacturers strive to enhance battery performance and reduce costs. Consequently, the Electric Vehicle Battery Market is experiencing significant growth, with projections indicating a compound annual growth rate of over 20% in the coming years. This trend suggests that as electric vehicles become more mainstream, the market for electric vehicle batteries will expand correspondingly, driving innovation and investment in battery technologies.

Investment in Charging Infrastructure

Investment in charging infrastructure is a critical driver for the Electric Vehicle Battery Market. As the number of electric vehicles on the road increases, the need for accessible and efficient charging solutions becomes paramount. Governments and private entities are investing heavily in expanding charging networks, which enhances consumer confidence in electric vehicle adoption. In 2025, the number of public charging stations is expected to double, facilitating easier access for electric vehicle owners. This expansion of infrastructure not only supports the growth of the electric vehicle market but also stimulates demand for advanced battery technologies. The Electric Vehicle Battery Market stands to benefit from this trend, as improved charging infrastructure can lead to increased battery utilization and longer vehicle ranges, ultimately driving sales and market growth.

Consumer Awareness and Environmental Concerns

Consumer awareness regarding environmental issues is increasingly driving the Electric Vehicle Battery Market. As individuals become more informed about the impact of fossil fuels on climate change, there is a growing inclination towards electric vehicles as a cleaner alternative. Surveys indicate that a significant percentage of consumers prioritize sustainability when making vehicle purchasing decisions. This shift in consumer behavior is likely to propel the demand for electric vehicles, thereby increasing the need for efficient and reliable batteries. In 2025, it is projected that the market for electric vehicle batteries will expand significantly as more consumers opt for eco-friendly transportation solutions. The Electric Vehicle Battery Market is thus positioned to thrive in an environment where environmental consciousness is at the forefront of consumer choices.

Government Regulations and Emission Standards

Government regulations and stringent emission standards are significantly influencing the Electric Vehicle Battery Market. Many countries are implementing policies aimed at reducing greenhouse gas emissions, which in turn encourages the adoption of electric vehicles. For instance, several nations have set ambitious targets to phase out internal combustion engine vehicles by 2030 or 2040. These regulatory frameworks create a favorable environment for electric vehicle manufacturers, thereby increasing the demand for electric vehicle batteries. In 2025, it is anticipated that the market will see a substantial increase in battery production to meet these regulatory requirements. This regulatory push not only drives the growth of the Electric Vehicle Battery Market but also fosters innovation as companies strive to develop batteries that comply with evolving standards.

Technological Innovations in Battery Chemistry

Technological advancements in battery chemistry are reshaping the Electric Vehicle Battery Market. Innovations such as solid-state batteries and lithium-sulfur batteries promise to enhance energy density and safety while reducing charging times. These developments are crucial as they address the limitations of traditional lithium-ion batteries, which have dominated the market. In 2025, the market for solid-state batteries is projected to reach a valuation of several billion dollars, indicating a shift towards more efficient energy storage solutions. As manufacturers invest in research and development, the Electric Vehicle Battery Market is likely to witness a transformation in battery performance, leading to longer driving ranges and improved consumer satisfaction. This ongoing evolution in battery technology is expected to play a pivotal role in the overall growth of the electric vehicle sector.