Consumer Awareness and Education

Increasing consumer awareness regarding the benefits of electric vehicles is driving the battery management-system-electric-vehicles market. Educational initiatives and marketing campaigns have successfully informed potential buyers about the advantages of EVs, including lower operating costs and reduced environmental impact. As consumers become more knowledgeable, their willingness to invest in electric vehicles grows, leading to higher demand for effective battery management systems. These systems play a vital role in ensuring that EVs deliver on their promises of efficiency and reliability. The battery management-system-electric-vehicles market is thus likely to see continued growth as consumer education efforts persist and the market matures.

Advancements in Battery Technology

Technological innovations in battery technology are significantly influencing the battery management-system-electric-vehicles market. Recent developments in lithium-ion and solid-state batteries have led to improved energy density, faster charging times, and enhanced safety features. For instance, the introduction of solid-state batteries could potentially increase the range of EVs by up to 50%, making them more appealing to consumers. As these advancements continue to evolve, the need for sophisticated battery management systems becomes paramount to ensure optimal performance and safety. The battery management-system-electric-vehicles market is likely to experience substantial growth as manufacturers integrate these advanced technologies into their products.

Rising Demand for Electric Vehicles

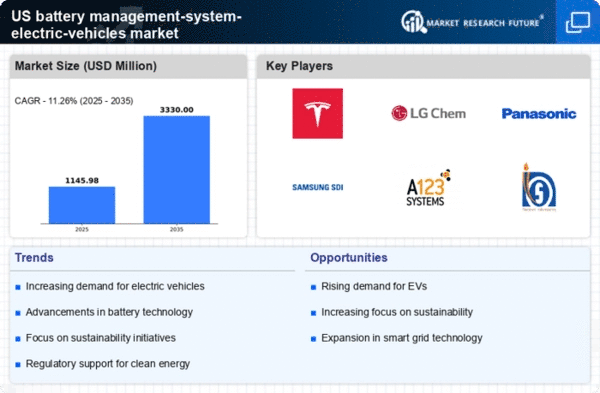

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the battery management-system-electric-vehicles market. As of 2025, EV sales in the US have surged, with projections indicating a growth rate of approximately 25% annually. This trend is largely attributed to heightened awareness of environmental issues and the desire for sustainable transportation solutions. Consequently, the demand for efficient battery management systems has intensified, as these systems are crucial for optimizing battery performance and longevity. The battery management-system-electric-vehicles market is thus positioned to benefit from this rising demand, as manufacturers seek to enhance the efficiency and reliability of their EV offerings.

Government Regulations and Standards

Stringent government regulations regarding emissions and fuel efficiency are driving the battery management-system-electric-vehicles market. The US government has implemented various policies aimed at reducing greenhouse gas emissions, which has led to increased investment in EV technology. For example, the Corporate Average Fuel Economy (CAFE) standards mandate that automakers improve the fuel efficiency of their fleets, indirectly promoting the adoption of electric vehicles. As a result, the demand for advanced battery management systems that comply with these regulations is expected to rise. This regulatory environment creates a favorable landscape for the battery management-system-electric-vehicles market, as manufacturers strive to meet compliance while enhancing vehicle performance.

Growing Infrastructure for EV Charging

The expansion of EV charging infrastructure is a critical driver for the battery management-system-electric-vehicles market. As of 2025, the US has seen a significant increase in the number of public charging stations, with estimates suggesting a growth of over 30% in the past year alone. This development not only alleviates range anxiety among consumers but also encourages the adoption of electric vehicles. Consequently, the battery management-system-electric-vehicles market is poised to benefit from this trend, as efficient battery management systems are essential for optimizing charging processes and ensuring battery health. The synergy between charging infrastructure and battery management systems is likely to enhance the overall EV experience.