Rising Need for Secure Communication

The Global Private LTE Market Industry is driven by the escalating need for secure communication solutions. Organizations across various sectors, including defense, energy, and healthcare, prioritize data security and privacy in their operations. Private LTE Market networks offer enhanced security features, such as encryption and dedicated bandwidth, which are essential for protecting sensitive information. This growing emphasis on security is prompting organizations to invest in private LTE solutions, thereby expanding the market. As the demand for secure communication continues to rise, the private LTE market is likely to experience sustained growth, aligning with the broader trends of digital transformation and cybersecurity.

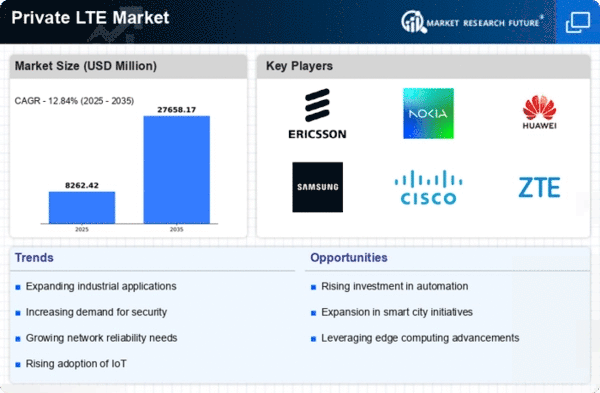

Chart: Global Private LTE Market Growth

The Global Private LTE Market Industry is characterized by robust growth projections. The market is expected to reach 7.32 USD Billion in 2024 and is anticipated to expand to 27.7 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 12.84% from 2025 to 2035. The increasing adoption of private LTE solutions across various industries underscores the market's potential and the importance of secure, reliable communication networks in the digital age.

Regulatory Support for Private Networks

The Global Private LTE Market Industry benefits from favorable regulatory frameworks that encourage the deployment of private networks. Governments worldwide are increasingly recognizing the importance of secure and reliable communication infrastructures, particularly in critical sectors such as public safety and emergency services. Regulatory bodies are facilitating access to spectrum and providing guidelines for the establishment of private LTE networks. This supportive environment fosters innovation and investment, allowing organizations to leverage private LTE for enhanced operational capabilities. As a result, the market is poised for growth, with a projected CAGR of 12.84% from 2025 to 2035, indicating a robust future for private LTE solutions.

Growing Demand for Enhanced Connectivity

The Global Private LTE Market Industry experiences a surge in demand for enhanced connectivity across various sectors. Industries such as manufacturing, logistics, and healthcare increasingly rely on robust communication networks to support critical operations. The need for low latency and high reliability in data transmission drives organizations to adopt private LTE solutions. As a result, the market is projected to reach 7.32 USD Billion in 2024, reflecting a growing recognition of the benefits of private networks. Enhanced connectivity not only improves operational efficiency but also facilitates the implementation of advanced technologies such as IoT and automation, further propelling market growth.

Increased Investment in Digital Transformation

The Global Private LTE Market Industry is significantly influenced by the rising investment in digital transformation initiatives. Organizations are increasingly recognizing the necessity of modernizing their infrastructure to remain competitive in a rapidly evolving digital landscape. Private LTE Market networks provide a secure and reliable platform for deploying digital solutions, enabling businesses to streamline operations and enhance customer experiences. This trend is expected to contribute to the market's growth, with projections indicating a rise to 27.7 USD Billion by 2035. As companies invest in digital technologies, the demand for private LTE solutions is likely to expand, driving further innovation and adoption.