Market Analysis

In-depth Analysis of Private LTE Market Industry Landscape

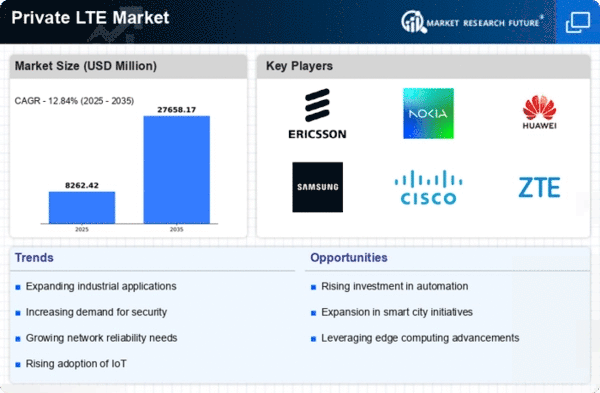

The growing demand for safe and reliable communication networks across organizations is changing Private LTE market aspects. Private LTE networks enable enterprises to meet specific availability demands with improved execution. The growing popularity of Modern Internet of Things (IIoT) applications, where Private LTE networks interface and manage many devices, drives this industry.

Manufacturing, medical services, coordinated factors, and energy companies are seeing the benefits of Private LTE in ensuring constant communication and information flow. Private LTE organizations are in demand because they offer a more reliable and efficient alternative to Wi-Fi and public LTE networks for critical applications that require minimal dormancy and high data transfer speeds.

Private LTE is also gaining popularity due to security concerns. Due to their improved security, Private LTE networks are appealing to organizations that handle sensitive data or work in restricted industries like finance and medicine. These organizations may be adjusted to match specific security needs, providing important control over fundamental data and preventing unauthorized access.

Changing distant communication regulations are also influencing Private LTE market factors. Private LTE networks are using 5G foundation's better data speeds, decreased idleness, and increased limit as it develops. This combination with 5G lets companies future-proof their communication networks and profit from emerging innovations that require more availability.

Competitive rivalry also shapes Private LTE markets. Competition increases as traditional telecom merchants, network framework providers, and specialist arrangement suppliers flood the market. This competition fosters growth as companies provide unique features, smart solutions, and customized services to stand out.

Additionally, the administrative atmosphere shapes Private LTE market characteristics. Government agencies recognize the importance of private LTE networks in economic growth and foundation support. Designating dedicated range groups for private use and smoothing administrative cycles help Private LTE adoption.

However, issues including shipping fees and the need for skilled workers to manage these groups prevent Private LTE from being widely used. Organizations considering Private LTE should weigh the benefits against the investment and consider the long-term benefits of functional effectiveness, security, and adaptability.

Leave a Comment