Focus on Security and Data Privacy

In an era where data breaches and cyber threats are prevalent, the private lte market in Canada is witnessing a heightened focus on security and data privacy. Organizations are increasingly aware of the vulnerabilities associated with public networks and are turning to private lte solutions to safeguard their sensitive information. The private lte market offers enhanced security features, such as encryption and dedicated bandwidth, which are crucial for industries handling confidential data. As a result, businesses are more inclined to invest in private lte networks to mitigate risks and ensure compliance with regulatory standards. This emphasis on security is likely to drive growth in the private lte market, as companies prioritize the protection of their digital assets.

Emergence of Industry-Specific Solutions

The private LTE market in Canada is evolving with the emergence of industry-specific solutions tailored to meet the unique needs of various sectors. For instance, the mining industry requires reliable communication for remote operations, while the healthcare sector demands high-quality connectivity for telemedicine applications. This trend indicates a shift towards customized private lte solutions that address specific operational challenges. As industries recognize the benefits of tailored communication systems, the private lte market is expected to expand. Companies are likely to invest in these specialized solutions to enhance productivity and operational efficiency, thereby driving the overall growth of the private lte market.

Growing Demand for Enhanced Connectivity

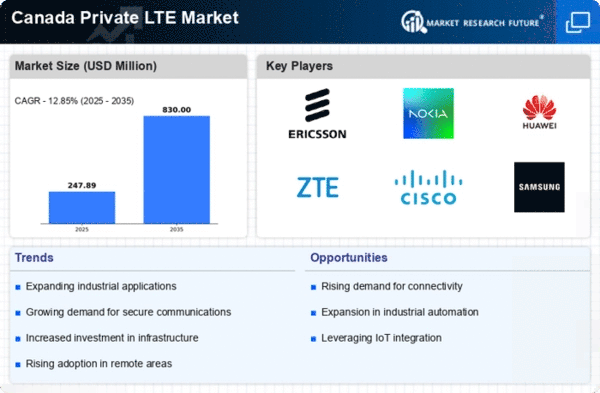

The private LTE market in Canada is experiencing a surge in demand for enhanced connectivity solutions across various sectors. Industries such as mining, oil and gas, and manufacturing are increasingly reliant on robust communication networks to support their operations. This demand is driven by the need for real-time data transmission, remote monitoring, and automation. According to recent estimates, the private lte market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the industry's shift towards more reliable and secure communication systems, which are essential for maintaining operational efficiency and safety in critical environments. As organizations seek to improve their connectivity, the private lte market is poised to play a pivotal role in facilitating these advancements.

Investment in Infrastructure Development

Infrastructure development is a key driver for the private lte market in Canada, as organizations invest in building and upgrading their communication networks. The Canadian government has recognized the importance of digital infrastructure and has allocated significant funding to enhance connectivity in rural and remote areas. This investment is expected to bolster the private lte market, as businesses seek to leverage these improvements for their operations. With an estimated investment of over $1 billion in telecommunications infrastructure, the private lte market is likely to benefit from increased access to high-speed networks. This trend not only supports economic growth but also enhances the competitiveness of Canadian industries, making them more attractive to both domestic and international stakeholders.

Increased Collaboration with Technology Providers

Collaboration between businesses and technology providers is becoming a significant driver for the private lte market in Canada. As organizations seek to implement advanced communication solutions, partnerships with technology firms are essential for accessing the latest innovations. These collaborations often lead to the development of integrated systems that combine hardware and software, enhancing the functionality of private lte networks. The private lte market is likely to benefit from these synergies, as companies leverage the expertise of technology providers to optimize their communication infrastructure. This trend not only fosters innovation but also accelerates the adoption of private lte solutions across various industries, contributing to the market's growth.