Rising Cybersecurity Concerns

In the context of the private lte market, rising cybersecurity concerns are prompting organizations in France to seek more secure communication solutions. With the increasing frequency of cyber threats, businesses are prioritizing the protection of their data and communication channels. Private LTE networks offer enhanced security features compared to traditional public networks, making them an attractive option for organizations handling sensitive information. This heightened focus on cybersecurity is likely to drive investment in private LTE solutions, as companies aim to safeguard their operations against potential breaches. it is thus positioned to benefit from this trend, as organizations recognize the importance of secure communication in maintaining their competitive edge.

Advancements in Network Technology

Technological advancements are playing a crucial role in shaping the private lte market in France. Innovations in network infrastructure, such as the development of more efficient radio access technologies and improved core network capabilities, are enhancing the performance of private LTE solutions. These advancements enable organizations to deploy networks that are not only faster but also more reliable and scalable. As businesses increasingly recognize the benefits of adopting cutting-edge technologies, the private lte market is likely to see a rise in demand for these advanced solutions. The continuous evolution of network technology is expected to drive further growth in the private lte market, as companies seek to stay ahead in a competitive landscape.

Growing Demand for Reliable Connectivity

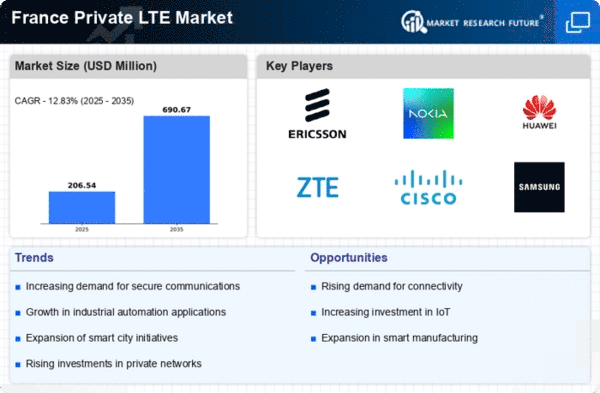

The private lte market in France is experiencing a surge in demand for reliable connectivity solutions across various sectors. Industries such as manufacturing, logistics, and energy are increasingly relying on private LTE networks to ensure uninterrupted communication and data transfer. This trend is driven by the need for enhanced operational efficiency and real-time data access. According to recent estimates, the private lte market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the industry's response to the rising expectations for seamless connectivity, which is essential for modern business operations. As organizations seek to optimize their processes, the private lte market is likely to play a pivotal role in facilitating this transformation.

Regulatory Support and Policy Frameworks

The private lte market in France benefits from a supportive regulatory environment that encourages the deployment of private networks. The French government has implemented policies aimed at promoting digital transformation and enhancing telecommunications infrastructure. This includes initiatives that facilitate spectrum allocation for private LTE networks, enabling businesses to establish their own secure communication channels. The regulatory framework is designed to foster innovation and investment in the telecommunications sector, which is crucial for the growth of the private lte market. As a result, companies are more inclined to invest in private LTE solutions, knowing that they are supported by favorable policies that align with their operational needs.

Increased Focus on Industry 4.0 Initiatives

The private lte market in France is significantly influenced by the ongoing shift towards Industry 4.0, which emphasizes automation, data exchange, and smart manufacturing. As industries adopt advanced technologies such as artificial intelligence and machine learning, the demand for robust and secure communication networks becomes paramount. Private LTE networks provide the necessary infrastructure to support these initiatives, offering low latency and high reliability. This alignment with Industry 4.0 trends is expected to drive substantial growth in the private lte market, as businesses seek to leverage these technologies for competitive advantage. The integration of private LTE solutions is likely to enhance operational capabilities and facilitate the transition to more automated processes.