Growing Need for Network Security

The increasing focus on network security is a prominent driver for the private lte market in Italy. As businesses and organizations become more aware of the vulnerabilities associated with traditional communication networks, there is a growing demand for private lte solutions that offer enhanced security features. This is particularly relevant in sectors such as healthcare, finance, and critical infrastructure, where data breaches can have severe consequences. The Private LTE Market is likely to see a rise in adoption as companies seek to protect sensitive information and ensure compliance with stringent regulations. With an estimated 30% of organizations in Italy prioritizing cybersecurity investments, the private lte market is positioned to benefit from this heightened emphasis on secure communication.

Investment in Smart Infrastructure

Investment in smart infrastructure is a critical driver for the private lte market in Italy. The Italian government and private sector are increasingly focusing on developing smart cities and enhancing urban infrastructure. This includes the deployment of advanced communication networks that can support various applications, such as smart traffic management, public safety, and environmental monitoring. The private lte market is expected to benefit from these initiatives, as they require reliable and high-speed connectivity. With an estimated investment of over €10 billion in smart city projects by 2030, the demand for private lte solutions is anticipated to rise significantly. This investment not only enhances the quality of life for citizens but also positions Italy as a leader in technological innovation, further driving the private lte market.

Rising Demand for Enhanced Connectivity

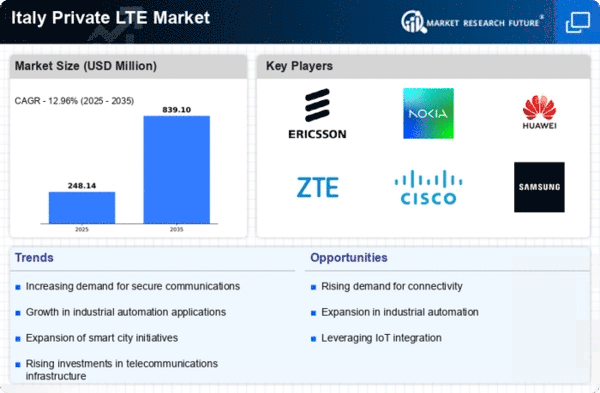

The private lte market in Italy is experiencing a notable surge in demand for enhanced connectivity solutions. Industries such as manufacturing, logistics, and energy are increasingly reliant on robust communication networks to support their operations. This trend is driven by the need for real-time data transmission and improved operational efficiency. According to recent estimates, The Private LTE Market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the industry's shift towards more reliable and secure communication infrastructures, which are essential for the seamless integration of IoT devices and automation technologies. As businesses seek to optimize their processes, The Private LTE Market is likely to play a pivotal role in facilitating these advancements.

Expansion of Industrial IoT Applications

The expansion of industrial IoT applications is significantly influencing the private lte market in Italy. As industries increasingly adopt IoT technologies to enhance productivity and efficiency, the demand for reliable and high-speed communication networks is growing. Private lte networks provide the necessary infrastructure to support a wide range of IoT applications, from remote monitoring to predictive maintenance. This trend is particularly evident in sectors such as manufacturing and agriculture, where real-time data analysis is crucial. The Private LTE Market is projected to capture a substantial share of the IoT connectivity landscape, with estimates suggesting that IoT-related investments in Italy could reach €5 billion by 2026. This growth underscores the importance of private lte solutions in facilitating the digital transformation of various industries.

Regulatory Support for Telecommunications

Regulatory support for telecommunications is a vital driver for the private lte market in Italy. The Italian government has implemented various policies aimed at promoting the development and deployment of advanced communication technologies. This includes initiatives to streamline the licensing process for private lte networks and provide financial incentives for businesses to invest in these solutions. Such regulatory frameworks are designed to foster innovation and enhance competition within the telecommunications sector. As a result, the private lte market is likely to benefit from increased investment and infrastructure development. With the government aiming to improve connectivity across the country, The Private LTE Market is positioned to thrive in this supportive regulatory environment.