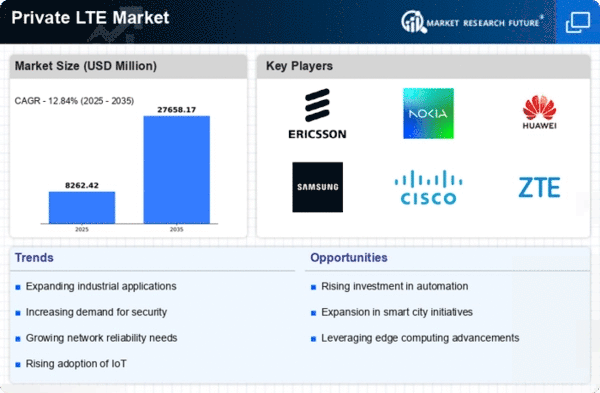

Top Industry Leaders in the Private LTE Market

Competitive Landscape of Private LTE Market:

The competitive landscape of the Private LTE market is characterized by intense rivalry among key players, each striving to carve out a significant share in this rapidly evolving sector. Companies operating in this space employ a variety of strategies to gain a competitive edge, ranging from technological advancements to strategic partnerships and mergers and acquisitions. The following provides a detailed overview of the competitive dynamics, strategies adopted, factors influencing market share, and the emergence of new players in the Private LTE market.

Key Players:

- LM Ericsson (Sweden)

- Nokia Corporation (Finland)

- Huawei Technology Co. Ltd (China)

- Samsung Electronics (South Korea)

- Verizon Communications (US)

- Cisco Systems, Inc (US)

- Qualcomm Incorporated (US)

- ARRIS International Limited (US)

- Sierra Wireless (Canada)

- Future Technologies, LLC (US)

- Boingo Wireless, Inc (US)

- Casa Systems (US)

Strategies Adopted:

-

Product Innovation: Key players focus on continuous innovation to introduce advanced Private LTE solutions that cater to the evolving needs of industries such as manufacturing, healthcare, and logistics. This involves incorporating features like low latency, high reliability, and secure connectivity.

-

Vertical Integration: Some companies adopt a vertical integration strategy by offering end-to-end solutions, including hardware, software, and services. This approach allows them to provide seamless and integrated solutions, giving them a competitive advantage.

-

Global Expansion: Companies are actively expanding their geographical presence to tap into new markets and capitalize on the growing demand for Private LTE solutions worldwide. This expansion is often achieved through strategic partnerships or setting up regional offices.

Factors for Market Share Analysis:

-

Technological Capabilities: The ability to offer cutting-edge technologies, such as 5G-enabled Private LTE solutions, plays a crucial role in determining market share. Companies investing in research and development to stay ahead in the technological curve are more likely to capture a larger share of the market.

-

Industry Focus: Market share analysis is influenced by the level of specialization and focus on specific industries. Companies tailoring their solutions to meet the unique requirements of sectors like manufacturing, energy, or healthcare can gain a competitive advantage over more generalized competitors.

-

Customer Satisfaction: Companies that prioritize customer satisfaction and provide excellent post-sales support tend to retain customers and attract new ones. Positive customer feedback and references contribute significantly to building market share.

New and Emerging Companies:

-

Start-ups: The Private LTE market has witnessed the entry of several start-ups offering innovative solutions. These companies, often more agile and flexible, focus on niche markets or specific use cases and can disrupt the market dynamics.

-

Incumbent Players in Adjacent Markets: Companies with expertise in adjacent markets, such as industrial automation or IoT solutions, are entering the Private LTE space to capitalize on the convergence of technologies. These entrants leverage existing customer relationships to gain a foothold in the market.

-

Local Players: In some regions, local players are gaining prominence by providing tailored solutions that cater to specific regulatory and operational requirements. These players often have a deep understanding of the local market dynamics, giving them a competitive edge.

Current Company Investment Trends:

-

R&D Investments: Key market players allocate significant resources to research and development, aiming to stay at the forefront of technological advancements. Investments in developing 5G capabilities and exploring new use cases are common trends.

-

Acquisitions: Larger companies are actively acquiring smaller firms with specialized expertise to enhance their product offerings and expand their market reach. These acquisitions are strategic moves to consolidate market share and eliminate potential competitors.

-

Partnerships and Collaborations: Companies are increasingly forming partnerships and collaborations with telecommunications service providers, cloud service providers, and system integrators to create comprehensive solutions. These collaborations enable them to offer end-to-end services and strengthen their market position.

Latest Company Updates:

The market leaders in private wireless networking, Nokia, and XC Technology, a prominent Fortune 500 global provider of technology services, announced today the launch of DXC Signal Private LTE and 5G in 2023. This managed secure private wireless network and digitalization platform solution aids in the digital transformation of industrial enterprises. The two businesses have committed to offering top-notch private wireless networking solutions that will advance businesses into the future as part of a global, strategic alliance.

The global producer of environmentally friendly metallic flexible flow solution products, Aeroflex Industries Ltd., based in Mumbai, will launch its initial public offering (IPO) on Tuesday, August 22, 2023, and it will end on Thursday, August 24, 2023.

Global pioneer in visual technology EIZO Corporation announced today in Mumbai, Maharashtra, India, the opening of its new subsidiary, EIZO Private Limited, for 2023. With the founding of this wholly-owned subsidiary, EIZO has expanded its global reach as a leading supplier of premium visual solutions and opened its 11th overseas sales office.