Support for Autonomous Systems

The market is poised for growth due to the increasing support for autonomous systems across multiple sectors. Industries such as transportation, agriculture, and logistics are exploring the potential of autonomous vehicles and drones, which require reliable communication networks for operation. Private lte networks provide the low-latency and high-bandwidth connectivity necessary for these systems to function effectively. As the US government and private sector invest in the development of autonomous technologies, the private lte market is expected to expand significantly. This trend indicates a shift towards more advanced operational capabilities, where private lte networks play a crucial role in enabling the safe and efficient deployment of autonomous systems.

Increased Focus on Cybersecurity

In the context of the private lte market, the heightened focus on cybersecurity is emerging as a critical driver. Organizations are increasingly aware of the vulnerabilities associated with traditional communication networks, prompting a shift towards private lte solutions that offer enhanced security features. The private lte market is likely to benefit from this trend, as businesses prioritize secure data transmission and protection against cyber threats. With cyberattacks on the rise, the demand for private lte networks, which provide dedicated and secure communication channels, is expected to grow. This focus on cybersecurity not only safeguards sensitive information but also fosters trust among stakeholders, further propelling the private lte market.

Investment in Smart Manufacturing

The private lte market is significantly influenced by the ongoing investment in smart manufacturing initiatives. As industries strive to adopt Industry 4.0 principles, the need for robust and dedicated communication networks becomes paramount. Private lte networks provide the necessary infrastructure to support automation, robotics, and real-time analytics. In the US, the manufacturing sector is expected to allocate over $200 billion towards digital transformation by 2026, with a substantial portion directed towards private lte solutions. This trend indicates that the private lte market is becoming increasingly integral to the modernization of manufacturing processes, enabling enhanced operational efficiency and reduced downtime.

Expansion of Remote Work Capabilities

The private lte market is also being driven by the expansion of remote work capabilities across various industries. As organizations adapt to new work environments, the need for reliable and secure communication networks has become increasingly apparent. Private lte networks offer the flexibility and security required for remote operations, enabling employees to connect seamlessly from various locations. This trend is particularly relevant in sectors such as healthcare and education, where secure communication is essential. The private lte market is likely to see increased adoption as businesses invest in infrastructure that supports remote work, ensuring continuity and productivity in their operations.

Growing Demand for Enhanced Connectivity

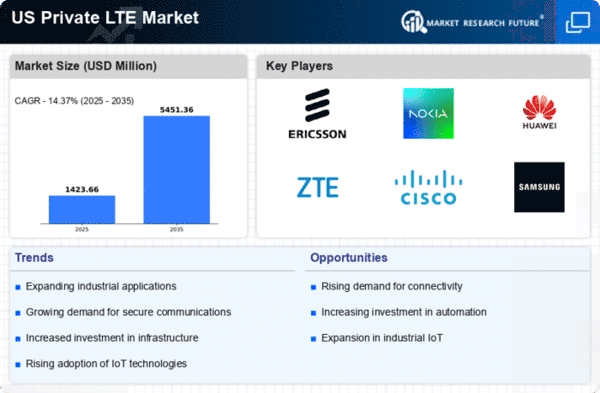

The private lte market is experiencing a surge in demand for enhanced connectivity solutions across various sectors. Industries such as manufacturing, logistics, and energy are increasingly recognizing the need for reliable and secure communication networks. This demand is driven by the necessity for real-time data transmission and operational efficiency. According to recent estimates, the private lte market is projected to grow at a CAGR of approximately 20% over the next five years. As organizations seek to improve their operational capabilities, The private LTE market is likely to play a pivotal role in facilitating seamless communication and data exchange, enhancing productivity and safety in critical operations.