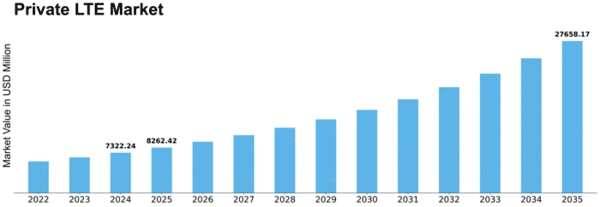

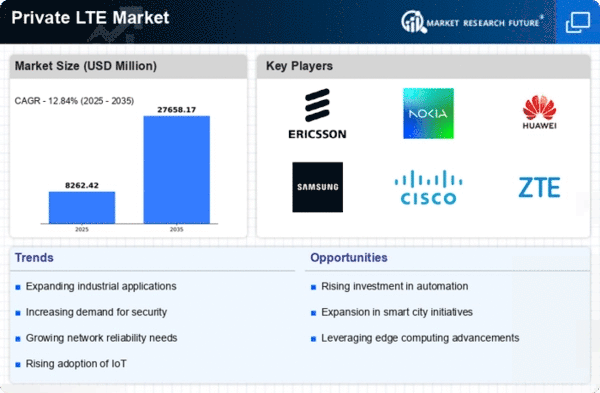

Private Lte Size

Private LTE Market Growth Projections and Opportunities

A lot of factors affect the Private LTE industry and its development. Businesses' growing need for reliable and secure communication networks is a major factor. Private LTE networks provide dedicated and managed environments for high availability and reduced dormancy. Manufacturing, medical services, energy, and strategy value private LTE for critical applications, robotization, and IoT devices.

In addition, Industry 4.0 development is crucial to the Private LTE market. As firms adapt to advanced change, excellent communication is essential. Private LTE networks have the transmission capacity and reliability to coordinate futuristic technologies like AI, machine learning, and mechanical technology. This mechanical combination boosts productivity, reduces personal time, and fosters growth, boosting private LTE interest.

Security concerns are also market factors. Compared to public organizations, private LTE networks are safer. This is essential for companies handling sensitive data like money and health. Designing and managing a closed company reduces digital risks and unauthorized access. As associations prioritize online security, private LTE networks will become more popular as a reliable communication method.

Private LTE has several uses, which drives market growth. Private LTE serves several purposes, from smart processing facilities to smart cities. Private LTE allows machine monitoring, prophetic assistance, and effective store network executives in assembly. Private LTE supports smart traffic boards, video surveillance, and public security in smart cities. Private LTE is interesting to organizations looking to update their availability framework due to its flexibility.

Government initiatives and regulations also shape the Private LTE market. Administrative assistance for range part, permission, and guidelines consistency affects private LTE firms' arrangement and interoperability. States that recognize the importance of cutting-edge communication technologies often implement initiatives that enable private LTE reception, fostering industry growth.

Another major factor affecting Private LTE is cost. While conveying a private LTE organization may be important, firms see the delayed cost reserve funds and functional efficiencies that result from a more evolved network. The Complete Cost of Possession (TCO) analysis often favors private LTE agreements, especially where margin time might cause major financial losses.

Leave a Comment