Environmental Concerns

Growing environmental concerns are influencing the Shared Ride Services Market as consumers increasingly prioritize sustainable transportation options. Ride-sharing reduces the number of vehicles on the road, leading to lower carbon emissions and decreased traffic congestion. Many cities are implementing policies to promote shared mobility as part of their sustainability initiatives. For instance, cities like Amsterdam have embraced ride-sharing as a means to reduce their carbon footprint. This shift towards eco-friendly transportation solutions is expected to bolster market growth, aligning with global efforts to combat climate change.

Increasing Urbanization

The Global Ride Sharing Market is experiencing a surge due to increasing urbanization. As more individuals migrate to urban areas, the demand for efficient transportation solutions rises. Urban centers often face congestion and limited parking, making ride-sharing an attractive alternative. For instance, cities like New York and Los Angeles have seen a significant uptick in ride-sharing usage as residents seek convenient mobility options. This trend is expected to contribute to the market's growth, with projections indicating a market value of 79.9 USD Billion in 2024, potentially reaching 150 USD Billion by 2035.

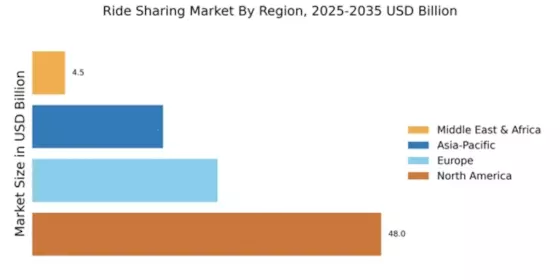

Market Growth Projections

The Ride Sharing Market is poised for substantial growth, with projections indicating a market value of 79.9 USD Billion in 2024 and an anticipated increase to 150 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.9% from 2025 to 2035. The expansion is driven by various factors, including urbanization, technological advancements, and changing consumer preferences. As the industry evolves, it is likely to adapt to emerging trends and challenges, positioning itself as a key player in the transportation sector.

Technological Advancements

Technological advancements play a pivotal role in shaping the Ride Sharing Market. The integration of mobile applications, GPS navigation, and real-time data analytics enhances user experience and operational efficiency. Companies are leveraging technology to optimize routes, reduce wait times, and improve safety features. For example, ride-sharing platforms are increasingly utilizing artificial intelligence to predict demand and manage driver availability. This technological evolution is likely to drive market growth, with a projected compound annual growth rate of 5.9% from 2025 to 2035, reflecting the industry's adaptability to technological innovations.

Changing Consumer Preferences

The Ride Sharing Sector is also being driven by changing consumer preferences, particularly among younger demographics. Millennials and Generation Z are more inclined to utilize ride-sharing services over traditional car ownership. This shift is attributed to factors such as cost-effectiveness, convenience, and a desire for flexible transportation options. As these generations continue to dominate the consumer landscape, ride-sharing services are likely to see increased adoption. This trend is indicative of a broader cultural shift towards shared mobility, which could significantly impact market dynamics in the coming years.

Government Initiatives and Regulations

Government initiatives and regulations are shaping the Ride Sharing Industry by fostering a conducive environment for ride-sharing operations. Many governments are implementing policies that support shared mobility, such as tax incentives and infrastructure investments. For example, cities are increasingly designating specific lanes for ride-sharing vehicles to enhance efficiency. Additionally, regulatory frameworks are evolving to ensure safety and accountability within the industry. These supportive measures are expected to stimulate market growth, as they create a favorable landscape for ride-sharing companies to thrive.