Integration of AI in Vehicle Manufacturing

The integration of artificial intelligence in vehicle manufacturing processes is a pivotal driver for the Automotive Artificial Intelligence Market. Manufacturers are increasingly adopting AI technologies to optimize production efficiency and reduce operational costs. For instance, AI-driven robotics and machine learning algorithms are being utilized to streamline assembly lines and improve quality control. This trend is expected to contribute to a more agile manufacturing environment, allowing companies to respond swiftly to market demands. As a result, the Automotive Artificial Intelligence Market is likely to see a rise in investments aimed at enhancing manufacturing capabilities, which could lead to a more competitive landscape.

Advancements in Machine Learning and Data Analytics

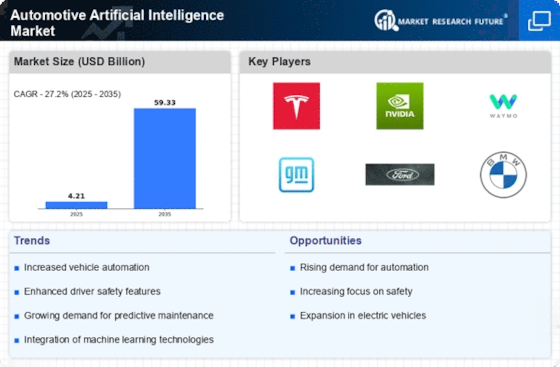

Advancements in machine learning and data analytics are propelling the Automotive Artificial Intelligence Market forward. These technologies enable vehicles to process vast amounts of data in real-time, enhancing decision-making capabilities and improving user experiences. For example, AI algorithms can analyze driving patterns and provide personalized recommendations to drivers, thereby increasing satisfaction and safety. The market for machine learning applications in automotive is expected to grow substantially, with projections indicating a potential increase of over 25% in the coming years. This trend underscores the importance of data-driven insights in shaping the future of the Automotive Artificial Intelligence Market.

Rising Demand for Advanced Driver Assistance Systems

The Automotive Artificial Intelligence Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). These systems, which utilize AI technologies, enhance vehicle safety and improve the driving experience. According to recent data, the ADAS segment is projected to grow at a compound annual growth rate of over 20% through the next few years. This growth is driven by increasing consumer awareness regarding road safety and the need for innovative features such as lane-keeping assistance and adaptive cruise control. As automakers integrate AI into their vehicles, the Automotive Artificial Intelligence Market is likely to witness a significant transformation, with a focus on reducing accidents and enhancing overall vehicle performance.

Increased Investment in Autonomous Vehicle Technology

Investment in autonomous vehicle technology is a significant driver for the Automotive Artificial Intelligence Market. As companies strive to develop fully autonomous vehicles, substantial resources are being allocated to research and development. This trend is evidenced by the billions of dollars invested by major automotive manufacturers and tech companies in AI research. The autonomous vehicle market is anticipated to grow rapidly, with estimates suggesting it could reach a valuation of over 500 billion dollars by 2030. This influx of investment not only accelerates technological advancements but also fosters collaboration between automotive and technology sectors, further propelling the Automotive Artificial Intelligence Market.

Growing Focus on Sustainability and Emission Reduction

Sustainability has become a critical focus within the Automotive Artificial Intelligence Market, as consumers and regulators alike demand lower emissions and environmentally friendly solutions. AI technologies are being leveraged to develop electric and hybrid vehicles that minimize carbon footprints. The market for electric vehicles is projected to expand significantly, with estimates suggesting that by 2030, electric vehicles could account for over 30% of total vehicle sales. This shift towards sustainable mobility is prompting automakers to invest in AI-driven innovations that enhance energy efficiency and reduce emissions, thereby reshaping the Automotive Artificial Intelligence Market.