Urbanization Trends

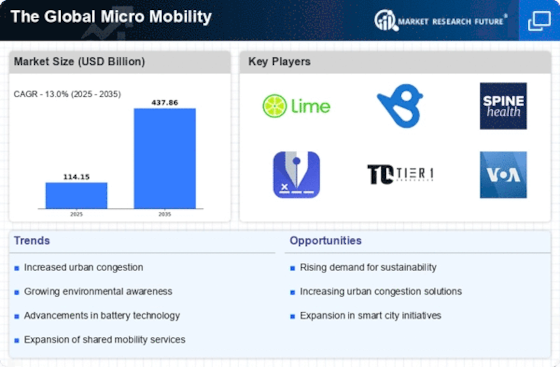

The rapid pace of urbanization is a key driver for The Global Micro Mobility Industry. As more individuals migrate to urban areas, the demand for efficient and convenient transportation solutions increases. Cities are becoming congested, leading to a pressing need for alternatives to traditional vehicles. Micro mobility options, such as e-scooters and bicycles, provide a practical solution for short-distance travel, reducing traffic congestion and pollution. According to recent data, urban areas are expected to house nearly 68% of the global population by 2050, further emphasizing the necessity for micro mobility solutions. This trend suggests that The Global Micro Mobility Industry will continue to expand as urban planners and policymakers seek to integrate these modes of transport into their infrastructure.

Environmental Concerns

Growing environmental concerns are significantly influencing The Global Micro Mobility Industry. As awareness of climate change and air pollution rises, consumers are increasingly seeking sustainable transportation options. Micro mobility solutions, which typically produce lower emissions compared to traditional vehicles, align with the global push for greener alternatives. Data indicates that the transportation sector accounts for approximately 14% of global greenhouse gas emissions, prompting governments and organizations to promote eco-friendly transport methods. The shift towards electric micro mobility options, such as e-bikes and e-scooters, further supports this trend. Consequently, The Global Micro Mobility Industry is likely to benefit from heightened consumer demand for environmentally responsible transportation solutions.

Government Initiatives

Government initiatives aimed at promoting sustainable transportation are a crucial driver for The Global Micro Mobility Industry. Many governments are implementing policies and incentives to encourage the use of micro mobility solutions. This includes the establishment of dedicated bike lanes, subsidies for e-scooter purchases, and regulations that support ride-sharing services. For example, cities are increasingly recognizing the need to reduce traffic congestion and improve air quality, leading to the implementation of supportive infrastructure. As a result, The Global Micro Mobility Industry is likely to experience growth as these initiatives create a favorable environment for micro mobility adoption, making it a viable alternative to traditional transportation.

Technological Advancements

Technological advancements play a pivotal role in shaping The Global Micro Mobility Industry. Innovations in battery technology, GPS tracking, and mobile applications have enhanced the user experience and operational efficiency of micro mobility solutions. For instance, the development of lightweight, long-lasting batteries has improved the range and performance of e-scooters and e-bikes, making them more appealing to consumers. Furthermore, the integration of smart technology allows for seamless ride-sharing and tracking, which enhances convenience and safety. As technology continues to evolve, it is anticipated that The Global Micro Mobility Industry will witness increased adoption rates, driven by enhanced features and functionalities that cater to consumer preferences.

Changing Consumer Preferences

Changing consumer preferences are reshaping the landscape of The Global Micro Mobility Industry. As urban dwellers seek more flexible and convenient transportation options, micro mobility solutions are becoming increasingly popular. The rise of the sharing economy has also contributed to this shift, with consumers favoring access over ownership. Data suggests that the demand for shared micro mobility services, such as bike-sharing and e-scooter rentals, is on the rise, particularly among younger demographics. This trend indicates a potential shift in transportation habits, where individuals prioritize convenience and sustainability. Consequently, The Global Micro Mobility Industry is poised for growth as it adapts to these evolving consumer preferences.