Rising Energy Demand

The Oil and Gas Pipelines Market is experiencing a surge in energy demand, driven by population growth and urbanization. As countries develop, the need for reliable energy sources becomes paramount. For instance, in 2024, the market is valued at approximately 80.4 USD Billion, reflecting the increasing investments in pipeline infrastructure to meet this demand. The expansion of cities and industrial sectors necessitates efficient transportation of oil and gas, leading to the construction of new pipelines and the enhancement of existing ones. This trend is expected to continue, with projections indicating a market growth to 187.8 USD Billion by 2035.

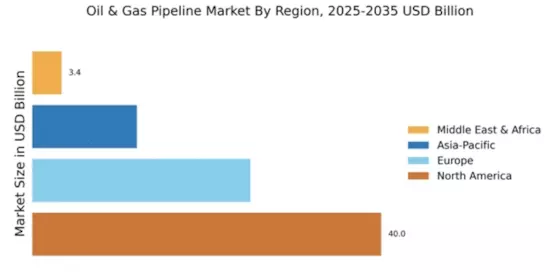

Global Trade Dynamics

The dynamics of global trade significantly influence the Oil and Gas Pipelines Market. As countries engage in international trade of oil and gas, the need for extensive pipeline networks becomes evident. Pipelines serve as the backbone for transporting these resources across borders, ensuring a steady supply to meet global demands. The increasing interdependence among nations for energy resources is likely to drive investments in cross-border pipeline projects. This trend is expected to enhance market growth, aligning with the projected increase in market value to 187.8 USD Billion by 2035, as countries seek to secure their energy supplies.

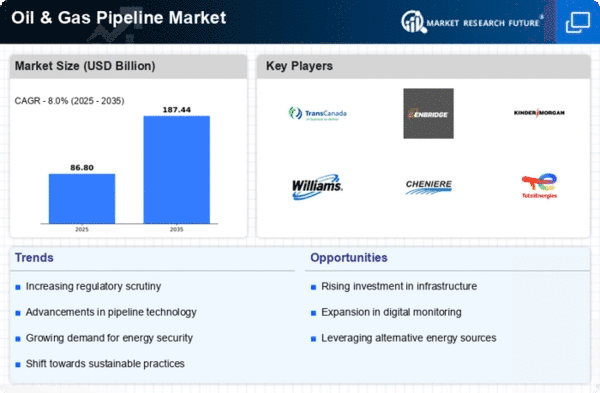

Market Growth Projections

The Oil and Gas Pipelines Industry is poised for substantial growth, with projections indicating a market value of 80.4 USD Billion in 2024 and an expected increase to 187.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 8.02% from 2025 to 2035. Such figures reflect the increasing investments in pipeline infrastructure, driven by rising energy demand, technological advancements, and regulatory support. The market's expansion is indicative of the critical role that pipelines play in the global energy landscape, facilitating the efficient transportation of oil and gas resources.

Technological Advancements

Technological innovations play a pivotal role in the Global Oil and Gas Pipelines Market, enhancing the efficiency and safety of pipeline operations. Advanced monitoring systems, automation, and predictive maintenance technologies are being integrated into pipeline management. These advancements not only reduce operational costs but also minimize environmental risks associated with pipeline leaks and failures. The adoption of smart pipeline technologies is likely to attract investments, further propelling market growth. As the industry evolves, these technologies are expected to contribute significantly to the projected CAGR of 8.02% from 2025 to 2035, indicating a robust future for pipeline infrastructure.

Environmental Considerations

Environmental concerns are increasingly shaping the Oil and Gas Pipelines Market. As awareness of climate change and ecological impacts grows, there is a push for more sustainable practices within the industry. Companies are investing in technologies that reduce emissions and minimize environmental footprints associated with pipeline operations. This shift towards sustainability is likely to influence pipeline design, construction, and maintenance practices. The industry's responsiveness to environmental challenges may enhance its reputation and attract investment, supporting the anticipated market growth to 187.8 USD Billion by 2035.

Regulatory Support and Policies

Government regulations and policies are crucial drivers in the Oil and Gas Pipelines Market. Many countries are implementing favorable policies to encourage investment in pipeline infrastructure, recognizing its importance for energy security and economic growth. For example, streamlined permitting processes and financial incentives for pipeline projects are becoming more common. This regulatory support not only facilitates the construction of new pipelines but also ensures compliance with environmental standards. As a result, the industry is likely to see increased activity, contributing to the overall market growth and the anticipated rise in market value to 187.8 USD Billion by 2035.