Rising Domestic Energy Consumption

China's rapidly increasing domestic energy consumption is a significant driver for the oil gas-pipeline market. With a population exceeding 1.4 billion and a burgeoning middle class, energy demand is projected to rise by approximately 3.5% annually. This escalating demand necessitates a robust pipeline infrastructure to ensure the efficient delivery of oil and gas resources. The government has recognized this need and is investing heavily in expanding pipeline capacity to meet future consumption levels. Additionally, the shift towards cleaner energy sources, such as natural gas, is further propelling the need for extensive pipeline networks. Consequently, the oil gas-pipeline market is poised for substantial growth as it adapts to the evolving energy landscape.

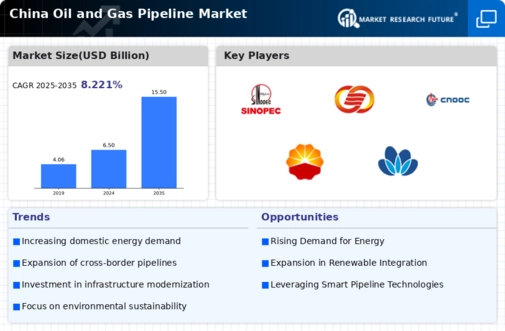

Infrastructure Development Initiatives

The oil gas-pipeline market in China is experiencing a surge in infrastructure development initiatives. The government has prioritized the expansion of pipeline networks to enhance energy security and facilitate the transportation of oil and gas. Recent reports indicate that investments in pipeline infrastructure have reached approximately $50 billion, reflecting a commitment to modernize and expand existing systems. This expansion is crucial for meeting the growing energy demands of urban areas and industrial sectors. Furthermore, the development of new pipelines is expected to create thousands of jobs, thereby stimulating economic growth. As a result, the oil gas-pipeline market is likely to benefit from increased operational efficiency and reduced transportation costs, positioning it favorably for future growth.

Geopolitical Factors and Energy Security

Geopolitical factors play a crucial role in shaping the oil gas-pipeline market in China. The country's energy security strategy is heavily influenced by its need to secure stable energy supplies from diverse sources. Recent tensions in international relations have prompted China to diversify its energy import routes and sources, leading to increased investments in pipeline projects. For instance, the construction of pipelines connecting to Central Asia and Russia is seen as a strategic move to mitigate risks associated with over-reliance on maritime routes. This geopolitical landscape suggests that the oil gas-pipeline market will continue to evolve, driven by the need for enhanced energy security and resilience against external shocks.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a pivotal driver in the oil gas-pipeline market. Chinese companies are increasingly forming alliances with international firms to leverage technological expertise and enhance operational capabilities. These collaborations often focus on developing advanced pipeline technologies and improving safety standards. For instance, partnerships with companies from Europe and North America have facilitated knowledge transfer, leading to more efficient pipeline construction and maintenance practices. As a result, the oil gas-pipeline market is likely to witness enhanced competitiveness and innovation, which could lead to improved project timelines and reduced costs. This trend suggests a dynamic shift towards a more integrated and technologically advanced market.

Environmental Regulations and Sustainability Goals

The oil gas-pipeline market in China is significantly influenced by stringent environmental regulations and sustainability goals. The government has implemented policies aimed at reducing carbon emissions and promoting cleaner energy sources. As part of these initiatives, there is a growing emphasis on the development of environmentally friendly pipeline technologies. Companies are increasingly investing in research and development to create pipelines that minimize environmental impact. This shift not only aligns with national sustainability goals but also enhances the market's reputation. Furthermore, compliance with these regulations is likely to drive innovation within the oil gas-pipeline market, as firms seek to develop solutions that meet both regulatory requirements and consumer expectations.