Rising Energy Demand

The increasing energy demand in India is a primary driver for the oil gas-pipeline market. As the population grows and urbanization accelerates, the need for energy sources intensifies. The Indian government projects that energy consumption will rise by approximately 4.2% annually through 2030. This surge in demand necessitates the expansion of pipeline infrastructure to ensure efficient transportation of oil and gas. The oil gas-pipeline market is poised to benefit from this trend, as new projects are initiated to meet the energy needs of various sectors, including residential, industrial, and transportation. Furthermore, the government's focus on enhancing energy security and reducing dependence on imports further emphasizes the importance of developing a robust pipeline network.

Government Policy Support

Government policy support plays a pivotal role in shaping the oil gas-pipeline market. The Indian government has implemented various policies aimed at enhancing the efficiency and safety of pipeline operations. Initiatives such as the National Policy on Biofuels and the Pradhan Mantri Ujjwala Yojana are designed to promote cleaner fuels and improve access to energy. These policies not only encourage investment in the oil gas-pipeline market but also facilitate the development of a more resilient energy infrastructure. Furthermore, the government's commitment to reducing carbon emissions aligns with the need for a modernized pipeline network that can support cleaner energy sources, thereby fostering growth in the sector.

Focus on Renewable Energy Integration

The shift towards renewable energy sources is gradually influencing the oil gas-pipeline market. As India aims to achieve its target of 175 GW of renewable energy capacity by 2022, the integration of renewable energy into the existing energy infrastructure becomes essential. This transition may require modifications to the current pipeline systems to accommodate biogas and other alternative fuels. The oil gas-pipeline market is likely to adapt to these changes, potentially leading to the development of hybrid pipelines that can transport both traditional fossil fuels and renewable energy sources. This evolution reflects a broader trend towards sustainability and energy diversification in India's energy landscape.

Investment in Infrastructure Development

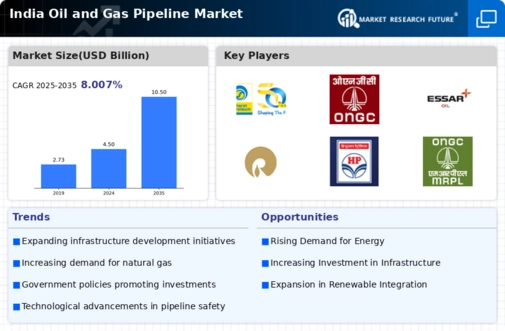

Investment in infrastructure development is a crucial factor influencing the oil gas-pipeline market. The Indian government has allocated substantial funds for the construction and upgrading of pipeline networks, with an estimated investment of $10 billion planned for the next five years. This investment aims to enhance connectivity between oil and gas production areas and consumption centers, thereby improving supply chain efficiency. Additionally, the government is promoting public-private partnerships to attract private investment in pipeline projects. This influx of capital is expected to stimulate growth in the oil gas-pipeline market, facilitating the construction of new pipelines and the modernization of existing ones to meet the increasing energy demands.

Technological Innovations in Pipeline Management

Technological innovations are transforming the oil gas-pipeline market, enhancing operational efficiency and safety. Advanced technologies such as smart sensors, automation, and data analytics are being increasingly adopted to monitor pipeline conditions and optimize maintenance schedules. These innovations can potentially reduce operational costs by up to 20%, making pipeline management more efficient. Moreover, the integration of digital technologies allows for real-time monitoring of pipeline integrity, which is crucial for preventing leaks and ensuring safety. As these technologies continue to evolve, they are likely to play a significant role in shaping the future of the oil gas-pipeline market, driving improvements in both performance and reliability.