Geopolitical Factors

Geopolitical factors are playing a significant role in the dynamics of the oil gas-pipeline market. The US's position as a leading oil and gas producer has implications for both domestic and international pipeline projects. Trade policies, tariffs, and international relations can impact the flow of resources and investment in pipeline infrastructure. For instance, tensions in key oil-producing regions may lead to fluctuations in supply and demand, influencing pricing and investment decisions. Additionally, the US's commitment to energy independence may drive the development of new pipelines to facilitate domestic production and reduce reliance on foreign imports. This geopolitical landscape is likely to continue shaping the strategies of companies operating within the oil gas-pipeline market.

Increasing Energy Demand

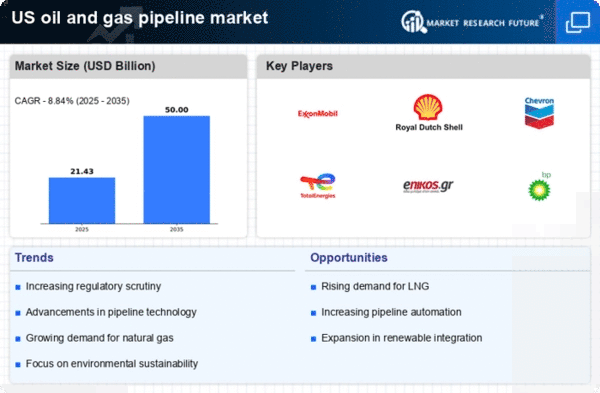

The oil gas-pipeline market is experiencing a surge in energy demand, driven by population growth and industrial expansion in the US. As the economy continues to recover, energy consumption is projected to rise, with the US Energy Information Administration estimating an increase of approximately 10% in energy needs by 2030. This heightened demand necessitates the expansion and enhancement of pipeline infrastructure to ensure efficient transportation of oil and gas. Consequently, investments in new pipeline projects are likely to increase, fostering growth within the oil gas-pipeline market. Furthermore, the shift towards natural gas as a cleaner energy source is expected to further stimulate demand, as it is increasingly utilized in power generation and industrial applications.

Environmental Regulations

The oil gas-pipeline market is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Regulatory bodies are implementing more rigorous standards for pipeline construction and operation, which may require companies to invest in cleaner technologies and practices. Compliance with these regulations is essential for maintaining operational licenses and avoiding substantial fines. As a result, the market is likely to see a shift towards more environmentally friendly practices, including the use of renewable energy sources in pipeline operations. This trend may also drive innovation in the development of low-impact pipeline technologies, further shaping the industry's future.

Infrastructure Investment

Significant investments in infrastructure are pivotal for the oil gas-pipeline market. The US government has recognized the necessity of modernizing and expanding pipeline networks to enhance energy security and reliability. Recent initiatives indicate that federal and state funding for pipeline projects could exceed $10 billion annually over the next decade. This influx of capital is likely to facilitate the construction of new pipelines and the upgrading of existing ones, thereby improving efficiency and safety. Additionally, the focus on reducing transportation bottlenecks is expected to drive further investment, as stakeholders seek to optimize supply chains and meet the growing energy demands of various sectors.

Technological Innovations

Technological innovations are transforming the oil gas-pipeline market, enhancing operational efficiency and safety. Advanced monitoring systems, such as smart sensors and real-time data analytics, are being integrated into pipeline operations, allowing for proactive maintenance and leak detection. These technologies not only reduce operational costs but also minimize environmental risks associated with pipeline failures. The adoption of automation and digitalization is projected to increase productivity by up to 20% in the coming years. As companies strive to remain competitive, the integration of cutting-edge technologies will likely play a crucial role in shaping the future landscape of the oil gas-pipeline market.