Shifts in Energy Demand Patterns

Shifts in energy demand patterns are influencing the oil gas-pipeline market in Europe. The transition towards renewable energy sources is prompting a reevaluation of traditional energy supply chains. As countries commit to reducing reliance on fossil fuels, the demand for oil and gas may experience fluctuations. However, natural gas is often viewed as a transitional fuel, leading to sustained demand for pipeline infrastructure to facilitate its distribution. Recent forecasts suggest that natural gas consumption in Europe could increase by 20% by 2030, necessitating the expansion of existing pipeline networks. This evolving landscape presents both challenges and opportunities for the oil gas-pipeline market, as companies must adapt to changing consumer preferences while ensuring reliable energy supply.

Regulatory Framework Enhancements

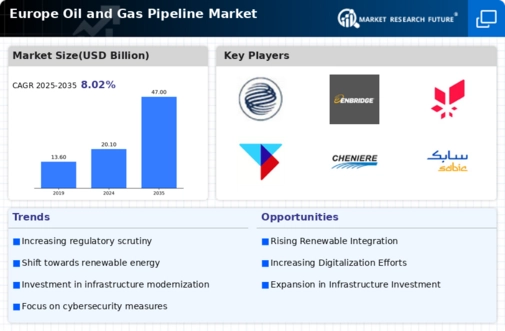

The oil and gas pipeline market in Europe. is currently influenced by evolving regulatory frameworks aimed at enhancing safety and environmental standards. Governments are increasingly implementing stringent regulations that require pipeline operators to adopt advanced technologies and practices. For instance, the European Union has set ambitious targets for reducing greenhouse gas emissions, which may compel companies to invest in more sustainable pipeline solutions. This regulatory environment is expected to drive innovation within the industry, as firms seek to comply with new standards while maintaining operational efficiency. The financial implications are notable, with estimates suggesting that compliance costs could reach up to €10 billion annually across the sector. Consequently, the regulatory landscape is a significant driver of change in the oil gas-pipeline market, pushing companies towards modernization and sustainability.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the oil gas-pipeline market in Europe. As demand for energy continues to rise, there is a pressing need for new pipeline projects to transport oil and gas efficiently. Recent reports indicate that the European pipeline infrastructure requires an estimated €30 billion in investments over the next decade to meet growing energy needs and replace aging systems. This influx of capital is likely to stimulate economic growth and create jobs within the sector. Furthermore, the European Commission's commitment to energy security and diversification of supply sources further emphasizes the importance of infrastructure development. As a result, the oil gas-pipeline market is poised for expansion, driven by both public and private investments aimed at enhancing the region's energy infrastructure.

Geopolitical Dynamics and Energy Security

Geopolitical dynamics play a crucial role in shaping the oil gas-pipeline market in Europe. The region's energy security is increasingly influenced by international relations and trade agreements. Tensions in key oil-producing regions can lead to supply disruptions, prompting European nations to seek alternative sources and routes for energy imports. This has resulted in strategic investments in pipeline projects that enhance energy independence and diversify supply chains. For instance, initiatives to develop pipelines connecting to non-Russian sources are gaining traction, reflecting a shift in policy aimed at reducing vulnerability to geopolitical risks. As a result, the oil gas-pipeline market is likely to experience growth driven by the need for secure and reliable energy supplies amidst an evolving geopolitical landscape.

Technological Advancements in Pipeline Monitoring

Technological advancements in pipeline monitoring are reshaping the oil gas-pipeline market in Europe. The integration of smart technologies, such as IoT sensors and AI-driven analytics, allows for real-time monitoring of pipeline conditions, significantly enhancing safety and efficiency. These innovations can reduce the risk of leaks and failures, which have historically posed challenges for the industry. According to industry estimates, the adoption of advanced monitoring technologies could decrease operational costs by up to 15%, while also improving response times to potential issues. As companies increasingly recognize the value of these technologies, investment in digital solutions is expected to grow, further driving the evolution of the oil gas-pipeline market. This trend not only enhances operational reliability but also aligns with broader sustainability goals within the sector.