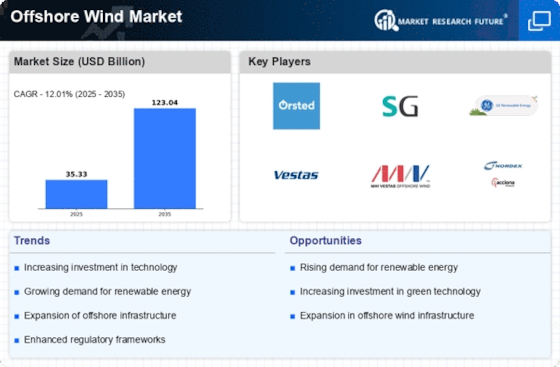

Rising Energy Demand

The Offshore Wind Market is experiencing a surge in energy demand, driven by increasing population and industrialization. As countries strive to meet their energy needs sustainably, offshore wind energy emerges as a viable solution. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This growing demand for clean energy sources propels investments in offshore wind projects, as they offer substantial capacity and efficiency. The Offshore Wind Market is thus positioned to play a crucial role in fulfilling energy requirements while reducing carbon emissions. Furthermore, the transition towards electrification in various sectors, including transportation and heating, further amplifies the need for renewable energy sources, making offshore wind a focal point in energy strategies.

Technological Innovations

Technological advancements are reshaping the Offshore Wind Market, enhancing efficiency and reducing costs. Innovations in turbine design, such as larger rotor diameters and higher capacity factors, have led to increased energy output. For instance, the latest offshore wind turbines can generate over 10 MW of power, significantly boosting the overall capacity of wind farms. Additionally, advancements in floating wind technology allow for deployment in deeper waters, expanding the geographical reach of offshore wind projects. These innovations not only improve the economic viability of offshore wind but also contribute to the industry's competitiveness against traditional energy sources. As technology continues to evolve, the Offshore Wind Market is likely to witness further enhancements that could lead to even greater efficiencies and lower costs.

Government Policies and Incentives

Supportive government policies and incentives are pivotal for the Offshore Wind Market. Many countries have established ambitious renewable energy targets, aiming for substantial contributions from offshore wind. For example, several nations have set goals to achieve 30 GW of offshore wind capacity by 2030. These policies often include financial incentives, such as tax credits and subsidies, which encourage investment in offshore wind projects. Furthermore, streamlined permitting processes and regulatory frameworks facilitate project development, reducing barriers to entry. As governments prioritize energy transition and climate commitments, the Offshore Wind Market stands to benefit from enhanced policy support, fostering a conducive environment for growth and investment.

Investment and Financing Opportunities

Investment in the Offshore Wind Market is witnessing a notable increase, driven by the growing recognition of its potential. Financial institutions and private investors are increasingly allocating capital to offshore wind projects, recognizing their long-term viability and profitability. Recent reports indicate that investments in offshore wind could exceed USD 200 billion by 2030, reflecting a robust growth trajectory. This influx of capital is essential for the development of new projects and the expansion of existing ones. Moreover, innovative financing models, such as green bonds and public-private partnerships, are emerging to support the Offshore Wind Market. These financial mechanisms not only facilitate project funding but also enhance investor confidence, contributing to the overall growth and sustainability of the industry.

Environmental Sustainability Initiatives

The Offshore Wind Market is increasingly aligned with global sustainability initiatives aimed at combating climate change. As nations commit to reducing greenhouse gas emissions, offshore wind energy presents a clean alternative to fossil fuels. The International Energy Agency indicates that offshore wind could provide up to 18% of the world's electricity by 2040, underscoring its potential in achieving climate goals. Additionally, the environmental benefits of offshore wind, such as minimal land use and low operational emissions, resonate with public sentiment and corporate responsibility initiatives. This alignment with sustainability objectives not only enhances the Offshore Wind Market's appeal but also attracts investments from environmentally conscious stakeholders, further driving growth.