Rising Energy Demand

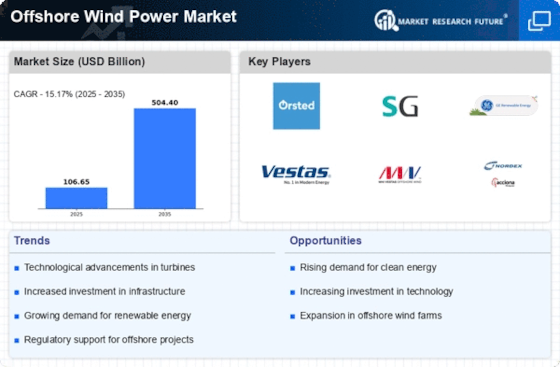

The Offshore Wind Power Market is experiencing a surge in energy demand, driven by increasing population and industrialization. As countries strive to meet their energy needs sustainably, offshore wind power emerges as a viable solution. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This growing demand for clean energy sources propels investments in offshore wind projects, as they offer substantial capacity and efficiency. The Offshore Wind Power Market is thus positioned to play a crucial role in fulfilling this energy gap, potentially leading to a significant increase in installed capacity and generation output in the coming years.

Technological Innovations

Technological advancements are reshaping the Offshore Wind Power Market, enhancing efficiency and reducing costs. Innovations such as larger turbine designs and floating wind farms are expanding the potential for offshore wind energy generation. For instance, the average capacity of offshore wind turbines has increased significantly, with some reaching over 10 MW. This trend suggests that the Offshore Wind Power Market is likely to see a substantial increase in energy output and a decrease in the levelized cost of energy. As technology continues to evolve, it may further drive the expansion of offshore wind projects, making them more competitive against traditional energy sources.

Government Policies and Incentives

Supportive government policies and incentives are pivotal for the Offshore Wind Power Market. Many countries are implementing favorable regulations and financial incentives to promote renewable energy development. For example, feed-in tariffs and tax credits are being utilized to encourage investments in offshore wind projects. Recent data indicates that countries with robust policy frameworks have seen a 50% increase in offshore wind capacity over the past five years. This trend underscores the importance of regulatory support in driving the Offshore Wind Power Market forward, as it creates a conducive environment for investment and innovation.

Investment and Financing Opportunities

The Offshore Wind Power Market is witnessing a surge in investment and financing opportunities, driven by the increasing recognition of offshore wind as a viable energy source. Financial institutions are increasingly willing to fund offshore wind projects, recognizing their long-term profitability and stability. Recent reports suggest that investments in offshore wind are expected to exceed USD 200 billion by 2030. This influx of capital not only supports the development of new projects but also fosters innovation within the Offshore Wind Power Market. As financial backing continues to grow, it may lead to accelerated project timelines and enhanced technological advancements.

Environmental Sustainability Initiatives

The Offshore Wind Power Market is significantly influenced by the global push for environmental sustainability. Governments and organizations are increasingly recognizing the need to reduce carbon emissions and combat climate change. Offshore wind power, with its minimal environmental footprint, is seen as a key player in achieving these sustainability goals. Recent studies indicate that transitioning to renewable energy sources, including offshore wind, could reduce greenhouse gas emissions by up to 70% by 2050. This commitment to sustainability not only enhances the Offshore Wind Power Market's attractiveness but also encourages further investments and technological innovations.