Market Trends

Introduction

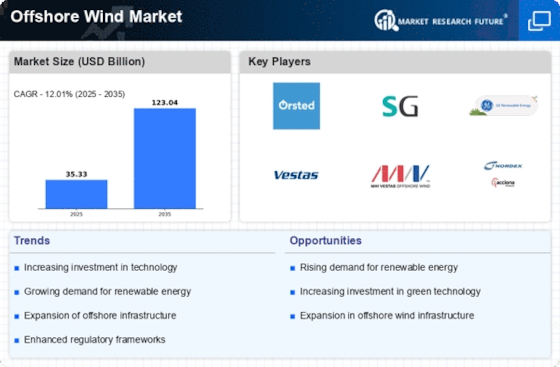

As we enter 2024, the offshore wind market is undergoing a major transformation driven by a confluence of macroeconomic factors. Technological developments are increasing the efficiency and scalability of wind energy solutions. Regulatory requirements are driving a faster take-up of renewable energy sources to meet climate goals. Also, changes in consumers’ preferences towards sustainable energy are influencing investment and development strategies. These trends are strategically important for all stakeholders, as they not only shape the competitive landscape but also shape the future of energy production and consumption. Taking a proactive approach to seize emerging opportunities is therefore key.

Top Trends

-

Increased Government Support

Governments all over the world are giving support to offshore wind power. The United States has set a goal of 30 gw by 2030. The European Union has set a goal of 300 gw by 2050. This is a significant change in direction. Support includes financial incentives and a shortened permit process, which are vital to the project’s viability. The industry’s leaders are accelerating their investment in new technology and infrastructure. In the future, the goal may be even more ambitious, as countries strive for energy independence. -

Technological Advancements

Offshore wind power is undergoing a radical change. Larger rotors and greater capacity factors are bringing it into the 21st century. The Siemens-Gamesa SG14-222 DD, for example, has a capacity of 15 MW, which increases the energy yield. And that reduces the cost of energy, making offshore wind power more competitive. In the long run, we can expect the cost of energy to continue falling, which will lead to a further increase in market growth and the attraction of new investment. -

Floating Wind Farms

Floating wind-power is gaining ground, especially in deep waters where the use of fixed-bottom machines is not feasible. Projects like the 30 m.w. capacity of the Hywind project in Scotland show the possibilities of the method. It is attracting new customers, as it makes wind-power available in areas where it was not available before. Future developments may see a greater investment in floating wind-power, leading to a more diverse energy portfolio. -

Supply Chain Resilience

The offshore wind supply chain has evolved to be more resistant to disruptions, as was demonstrated by the pandemic. To reduce the risks, companies are diversifying their suppliers and investing in local manufacturing. For example, Vestas has committed to establishing local production facilities in key markets. This not only strengthens the supply chain but also supports the local economy. The result is a more resilient and agile supply chain that can respond to global challenges. -

Integration with Energy Storage

Offshore wind power and storage solutions are becoming increasingly important for the stability of the grid. In a number of projects, hybrid solutions that combine wind power with battery storage are being developed, which increase the reliability of the supply. For example, RWE is investing in batteries for its offshore wind farms to optimize the supply of electricity. The efficiency of the systems is expected to increase further. -

Corporate Power Purchase Agreements (PPAs)

Corporate PPAs are a key driver of offshore wind projects, with companies seeking to secure renewable energy sources. By 2023, a record 13.1 GW of offshore wind capacity had been contracted under PPAs, reflecting a growing appetite among corporations. This not only gives the offshore wind industry a degree of financial stability but also helps companies meet their sustainability goals. With more corporations committing to green energy, demand for offshore wind is likely to grow substantially. -

Environmental and Social Governance (ESG) Focus

Social, economic and governance (ESG) criteria are increasingly influencing the decision to invest in offshore wind. Sustainability and local engagement are a priority for companies, as is shown by Orsted’s commitment to biodiversity. Transparency and accountability are also important to investors, which has led to higher reporting standards. The trend towards ESG criteria influencing the offshore wind industry’s strategy will probably continue. -

Digitalization and Smart Technologies

Digital technology is revolutionizing offshore wind power. Its implementation is increasing efficiency and reducing costs. The Internet of Things and artificial intelligence are being used to optimize maintenance and performance. For example, GE's digital twins are used to monitor the performance of its windmills in real time. The trend is to increase operational efficiency and thus the economic viability and attractiveness of offshore wind power. -

International Collaboration

The development of offshore wind energy requires international cooperation, as the North Sea Wind Power Hub initiative shows. Together, the countries of the region are working to create a shared energy grid and to strengthen the interconnection between the countries. This trend fosters the exchange of knowledge and the sharing of resources, which will accelerate the development of the projects. Future collaborations will help to integrate the energy markets and to create a single policy for the implementation of renewable energy. -

Decarbonization Goals

The drive to decarbonize is a driving force in the offshore wind market. Many countries have committed to zero emissions by the middle of the century. For example, the UK has set a target of zero emissions by 2050, which requires a significant increase in offshore wind capacity. This need for speed is driving investment in the necessary renewable technology and supporting offshore wind infrastructure. As decarbonization goals become more ambitious, the offshore wind industry is set to play a key role in meeting these goals and shaping future energy policies.

Conclusion: Navigating the Offshore Wind Landscape

In 2024, the Offshore Wind Energy Market will be characterized by intense competition and high fragmentation, with both established and newcomers vying for market share. The global trend is towards localized solutions, with suppliers adapting to the regulatory environment and consumers' preferences. The major companies are using their experience and established network to establish themselves, while the newcomers are focusing on innovation and sustainable practices. Artificial intelligence-based analysis, automation in operations, sustainable practices and flexibility in project execution will be key to market leadership. Strategic alliances and investments in these areas will be necessary for long-term success.

Leave a Comment