Market Analysis

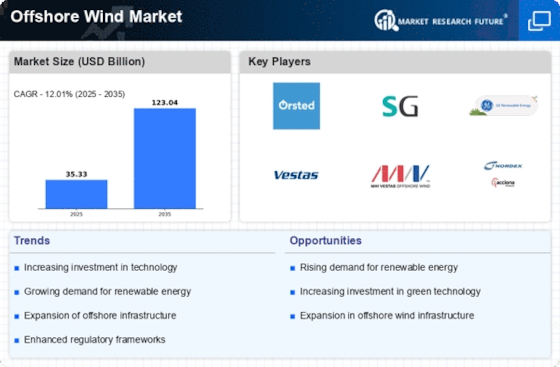

Offshore Wind Market (Global, 2024)

Introduction

Offshore wind energy is a fast-growing part of the global energy mix. In the context of the increasing emphasis on renewable energy sources and the need to respond to the challenge of climate change, offshore wind energy has emerged as a major player in the transition towards sustainable electricity generation. The sector is characterised by rapid technological development, new project financing models and a growing number of stakeholders, including governments, private investors and civil society organisations. In the context of the drive to meet ambitious climate goals, the expansion of offshore wind power is becoming a strategic priority, attracting increased investment and policy support. Offshore wind energy’s integration into national energy strategies is not only a way of diversifying the energy mix, but also a way of creating jobs and boosting the economy in coastal regions. The dynamics of the supply chains, the regulatory framework and technological innovation will be crucial to the success of the industry as it develops.

PESTLE Analysis

- Political

- In 2024 the offshore wind energy market will be influenced strongly by government policies to reduce carbon emissions. The European Union has set a target of 300 GW by 2030. By 2024 it is expected to have reached 50 GW. In support of this ambitious goal, many national governments have made substantial financial commitments, including the UK, which has allocated £160 million to develop floating wind power. In the United States, the Biden administration has set a target of 30 GW by 2030. By 2024 the goal is to have installed 7 GW. The commitment to offshore wind power is therefore strong.

- Economic

- The offshore wind market is booming. It is estimated that by 2024 the offshore wind market will be worth $45 billion. The UK will lead the way by investing about $12 billion in new offshore wind farms. In addition, the industry is expected to create around 77,000 jobs in the UK by 2024, largely through the development of the manufacturing and installation industry. Also contributing to this favourable economic outlook is the availability of low-interest loans for renewable energy projects. In 2024, the average interest rate on renewable energy loans is expected to be 3.5%.

- Social

- The public's support for offshore wind power is growing. In the United Kingdom, about 75% of the population living near the coast supports the construction of offshore wind farms. Social acceptance is essential for the successful implementation of projects, as local communities increasingly understand the advantages of a sustainable energy supply, including job creation and energy independence. Education and information campaigns are also being conducted, with more than 200 local workshops scheduled by 2024 to inform and involve local communities in offshore wind projects.

- Technological

- Progress in technology is pushing the offshore wind industry to a new level, with the possibility of reaching a maximum of 15 MW in 2024. Larger and more efficient windmills will increase the energy yield, with some projects achieving a capacity factor of more than 60%. The floating wind power is gaining ground. By 2024, more than ten floating wind farms will be in operation, demonstrating the possibilities for offshore wind farms in deeper waters. Also, digital technology, such as predictive maintenance and artificial intelligence, will reduce the cost of operation by an average of about 20%.

- Legal

- The regulatory framework for offshore wind power is evolving, with new legislation being introduced to facilitate the permitting process. In 2024, the Bureau of Ocean Energy Management will have granted over twenty new leases for offshore wind farms and the average time taken to issue a permit will have been reduced to around eighteen months. In the European Union, the Renewable Energy Directive requires member states to ensure that, by 2030, at least 32% of their energy comes from renewable sources, with a specific reference to offshore wind. These regulatory frameworks are essential for project viability and avoiding penalties.

- Environmental

- The offshore wind industry is becoming increasingly concerned with minimising its impact on the environment, and new projects must undergo extensive environmental impact assessments. The industry estimates that offshore wind farms will prevent the release of approximately 100 million tons of CO2 into the atmosphere each year by 2024, thereby contributing to the achievement of the UN’s climate goals. In addition, initiatives are being taken to protect marine life. Some thirty per cent of new projects already include measures to reduce the impact of construction on local wildlife. Also, the offshore wind industry is investing in research. In 2024, $200 million will have been spent on studies of the environmental effects of offshore wind farms.

Porter's Five Forces

- Threat of New Entrants

- The offshore wind market in 2024 is characterized by a moderate threat of new entrants. While the market is growing rapidly due to increasing demand for renewable energy, the high capital investment required for both the technological and the structural equipment deters new players. In addition, regulatory obstacles and the need for specialized knowledge limit the number of new entrants.

- Bargaining Power of Suppliers

- Suppliers in the offshore wind power market have a medium degree of bargaining power. The market is dependent on specialised components and technology, often supplied by a limited number of suppliers. As the market grows and more suppliers enter, the bargaining power of suppliers may decline, enabling companies to negotiate better terms.

- Bargaining Power of Buyers

- The buyer has considerable bargaining power in the offshore wind market because of the growing number of options as the market matures. Large energy companies and governments can use their buying power to negotiate advantageous contracts. The pressure to bring prices down for renewable energy increases the buyer’s influence on suppliers.

- Threat of Substitutes

- The threat of substitutes for offshore wind power is medium. There are other renewable energy sources, such as solar and hydropower, but offshore wind has a unique advantage of higher energy density and lower land occupation. However, the development of other renewable energy sources may also pose a threat in the future.

- Competitive Rivalry

- Competition is high in the offshore wind market, where many established companies and new entrants compete for market share. In the long run, the market is driven by the worldwide drive towards sustainable energy solutions. Companies are investing heavily in technology and in strategic alliances to strengthen their positions in the market, resulting in a dynamic and aggressive market situation.

SWOT Analysis

Strengths

- Abundant renewable energy source with high capacity factors.

- Technological advancements leading to increased efficiency and reduced costs.

- Strong government support and favorable policies promoting renewable energy.

- Growing public awareness and acceptance of clean energy solutions.

- Potential for job creation in manufacturing, installation, and maintenance.

Weaknesses

- High initial capital investment and long payback periods.

- Limited infrastructure and supply chain challenges in some regions.

- Environmental concerns and potential impact on marine ecosystems.

- Intermittency of wind energy requiring reliable backup systems.

- Regulatory hurdles and permitting processes can be lengthy.

Opportunities

- Expansion into emerging markets with untapped offshore wind potential.

- Integration with energy storage solutions to enhance reliability.

- Collaboration with technology firms for innovative solutions.

- Increased investment in research and development for next-generation turbines.

- Potential for hybrid projects combining wind with other renewable sources.

Threats

- Competition from other renewable energy sources, such as solar and hydro.

- Fluctuations in government policies and subsidies affecting market stability.

- Economic downturns impacting investment in renewable projects.

- Technological risks associated with new developments and installations.

- Geopolitical tensions affecting supply chains and international collaboration.

Summary

In 2024, the Offshore Wind Market is characterized by the presence of many strengths such as the abundance of renewable energy and strong government support, which is a favorable factor for the market to grow. However, the high initial cost and the regulatory obstacles still remain. Opportunities for market expansion and technological development are available, while competition and economic fluctuations can influence the market. Strategic innovation and cooperation will be necessary to take advantage of the opportunities and minimize the risks.

Leave a Comment