Offshore Wind Size

Market Size Snapshot

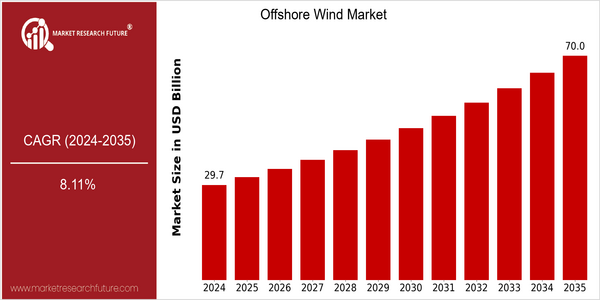

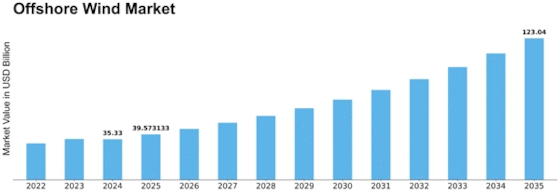

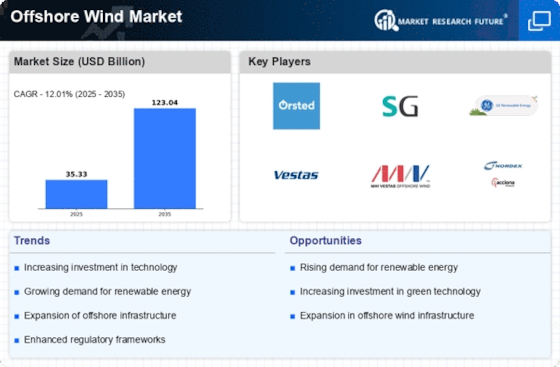

| Year | Value |

|---|---|

| 2024 | USD 29.68 Billion |

| 2035 | USD 70.0 Billion |

| CAGR (2025-2035) | 8.11 % |

Note – Market size depicts the revenue generated over the financial year

The offshore wind energy market is expected to grow significantly, from an expected market size of $29.68 billion in 2024, to $70 billion in 2035. This growth rate is a CAGR of 8.11% from 2025 to 2035. The main driving force for this market is the growing demand for alternative energy sources, resulting from the global effort to reduce carbon emissions and combat climate change. Also, the technological advances in the efficiency of the windmills, the development of floating wind farms, and the improvement of the installation methods will make offshore wind energy projects more viable and attractive, making them an essential part of the energy transition. The main players in the offshore wind industry, such as rsted, Siemens-Gamesa and Vestas, are investing heavily in the development of new technologies and in strategic alliances, to take advantage of this growth. These companies, for example, are investing in the development of floating windmills, such as rsted, and are investing in the development of larger, more efficient windmills, such as Siemens-Gamesa. The offshore wind energy market is booming as governments worldwide are implementing more and more favorable policies and subsidies to support the development of the renewable energy industry.

Regional Market Size

Regional Deep Dive

The offshore wind energy market is experiencing significant growth across various regions, driven by increasing energy demand, technological advancements, and government policies towards reducing carbon emissions. Each region has its own unique characteristics that influence the market dynamics, such as government policies, investment, and energy requirements. In order to meet their renewable energy goals, countries are investing in offshore wind energy. Technological advancements in windmills and project financing are crucial for the future of offshore wind energy.

Europe

- The United Kingdom, Germany and Denmark have also made significant investments in offshore wind farms, including the Hornsea project in the United Kingdom, which is expected to be the world's largest offshore wind farm.

- The European Union's Green Deal and the recent Offshore Renewable Energy Strategy aim to increase offshore wind capacity to 300 GW by 2050, driving innovation and collaboration among key players like Ørsted and Siemens Gamesa.

Asia Pacific

- China is rapidly expanding its offshore wind capacity, with the government targeting 50 GW by 2030, leading to significant investments in technology and infrastructure, particularly in provinces like Jiangsu and Guangdong.

- The recent establishment of the Asia Wind Energy Association aims to promote collaboration and knowledge sharing among countries in the region, enhancing the overall growth of the offshore wind market.

Latin America

- Latin America is witnessing a gradual interest in offshore wind, with countries like Brazil and Chile exploring their offshore wind potential, supported by favorable wind conditions and a growing demand for renewable energy.

- The Brazilian government has initiated regulatory frameworks to facilitate offshore wind projects, which is expected to attract investments and partnerships with international companies specializing in offshore wind technology.

North America

- The U.S. government has set ambitious targets for offshore wind energy, aiming for 30 GW of capacity by 2030, which has spurred investments and project developments along the East Coast, particularly in states like New York and Massachusetts.

- Notable projects include the Vineyard Wind project, which is set to be the first commercial-scale offshore wind farm in the U.S., and is expected to generate significant economic benefits and job creation in the region.

Middle East And Africa

- The Middle East is beginning to explore offshore wind potential, with countries like Saudi Arabia and the UAE investing in renewable energy projects, including the planned 1.2 GW offshore wind farm in Saudi Arabia's Red Sea region.

- Regulatory frameworks are evolving, with the Saudi government introducing initiatives to diversify its energy mix, which is expected to attract foreign investment and technology transfer in the offshore wind sector.

Did You Know?

“As of 2023, the global offshore wind capacity has surpassed 50 GW, with Europe accounting for over 80% of this capacity, showcasing the region's leadership in offshore wind energy development.” — Global Wind Energy Council (GWEC)

Segmental Market Size

The offshore wind market is experiencing a rapid expansion, mainly driven by the growing demand for renewable energy and the trend towards decarbonization. The main drivers are the stricter regulations on CO2 emissions, such as the European Union's Green Deal, and the technological improvements that increase the efficiency of windmills and reduce their costs. The United Kingdom and Denmark are at the forefront of this expansion and show by the Horns Rev 3 and Horns Rev that large-scale projects can be successfully adopted in this area. The market is currently in the stage of large-scale implementation, with many projects moving from pilot to full-scale operation. The main applications are the production of electricity for coastal cities and the integration into the national grid. The main suppliers of windmills are Siemens, Gamesa and Vestas. The growth is driven by macro trends such as the introduction of renewable energy and the emergence of sustainable energy. In addition, the introduction of floating wind technology opens up new areas for offshore wind farms, making previously unreachable areas available for energy production.

Future Outlook

The offshore wind market is expected to grow at a CAGR of 8.11% from 2024 to 2035, registering a growth of $29.68 billion to $70 billion. The offshore wind industry is expected to grow as a result of the global shift towards the use of renewable energy sources, as well as the stricter climate policies and increased investments in sustainable and greener energy. By 2035, offshore wind power is expected to be a significant part of the global energy mix, reaching a penetration of 15 to 20% in key markets such as Europe, North America, and Asia-Pacific, where there are favorable wind conditions and supportive policies. Also, key technological developments, such as the development of larger and more efficient windmills, floating wind farms, and energy storage solutions, will contribute to the viability and competitiveness of offshore wind energy. Government incentives and international collaborations to reduce CO2 emissions will also support the industry. Emerging trends, such as the use of digital technology for predictive maintenance and the development of hybrid energy systems combining offshore wind with other renewable energy sources, will also play an important role in the future development of the industry. The offshore wind industry will continue to grow as it is recognized as an important part of the energy transition.

Leave a Comment