Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver for the Healthcare Regulatory Affairs Outsourcing Market. By outsourcing regulatory affairs, companies can significantly reduce operational costs associated with hiring and training in-house staff. This is particularly relevant for small to mid-sized enterprises that may lack the financial resources to maintain a full regulatory team. In 2023, it was estimated that companies could save up to 30 percent on regulatory compliance costs by leveraging outsourcing solutions. This financial incentive encourages organizations to seek external expertise, allowing them to focus on core business activities while ensuring compliance with regulatory standards.

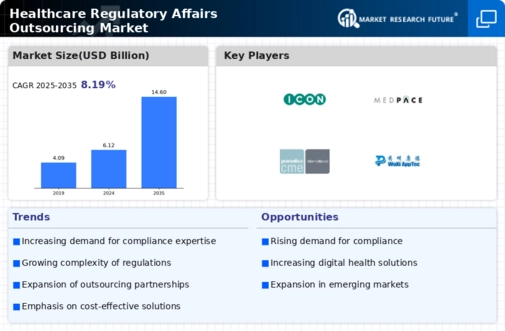

Rising Complexity of Regulatory Requirements

The increasing complexity of regulatory requirements across various regions is a primary driver for the Healthcare Regulatory Affairs Outsourcing Market. As regulations evolve, companies face challenges in maintaining compliance, which necessitates specialized knowledge and resources. This complexity is particularly evident in the pharmaceutical and biotechnology sectors, where the number of regulatory submissions has surged. In 2023, the number of new drug applications submitted to regulatory bodies increased by approximately 15 percent compared to previous years. Consequently, organizations are increasingly outsourcing regulatory affairs to ensure adherence to these intricate regulations, thereby enhancing their operational efficiency and reducing the risk of non-compliance.

Growing Demand for Market Access and Expansion

The growing demand for market access and expansion is a significant driver of the Healthcare Regulatory Affairs Outsourcing Market. As companies seek to enter new markets, they must navigate diverse regulatory landscapes, which can be complex and time-consuming. In 2023, the number of companies pursuing international market entry increased by 25 percent, highlighting the need for specialized regulatory support. Outsourcing regulatory affairs allows organizations to tap into local expertise and ensure compliance with regional regulations, thereby facilitating smoother market entry. This trend underscores the importance of regulatory affairs outsourcing in achieving strategic business objectives.

Increased Focus on Patient Safety and Efficacy

The heightened emphasis on patient safety and drug efficacy is driving the Healthcare Regulatory Affairs Outsourcing Market. Regulatory bodies are increasingly scrutinizing clinical trial data and post-market surveillance to ensure that products meet safety standards. This trend has led to a surge in demand for regulatory affairs services that can provide comprehensive support in navigating these requirements. In 2023, the number of safety-related regulatory submissions rose by 20 percent, reflecting the industry's commitment to prioritizing patient welfare. As a result, companies are turning to outsourcing partners to enhance their regulatory strategies and ensure compliance with evolving safety standards.

Technological Advancements in Regulatory Processes

Technological advancements are transforming the Healthcare Regulatory Affairs Outsourcing Market by streamlining regulatory processes. The integration of artificial intelligence and data analytics into regulatory affairs has the potential to enhance efficiency and accuracy in submissions. In 2023, approximately 40 percent of regulatory professionals reported using advanced technologies to facilitate compliance activities. This trend indicates a shift towards more data-driven decision-making in regulatory affairs, prompting organizations to seek outsourcing partners with expertise in these technologies. By leveraging innovative solutions, companies can improve their regulatory strategies and reduce time-to-market for new products.

Leave a Comment