Increasing Healthcare Expenditure

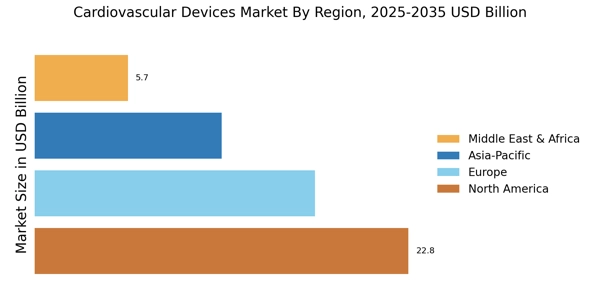

The rise in healthcare expenditure across various regions is significantly influencing the Cardiovascular Devices Market. Governments and private sectors are allocating more resources to healthcare, driven by the need to improve patient outcomes and reduce the economic burden of cardiovascular diseases. In many countries, healthcare spending is projected to grow at an annual rate of 5% or more, facilitating investments in advanced medical technologies. This financial commitment enables healthcare providers to acquire state-of-the-art cardiovascular devices, thereby enhancing treatment capabilities. Additionally, the growing emphasis on value-based care is prompting healthcare systems to adopt innovative solutions that improve efficiency and patient satisfaction. As a result, the Cardiovascular Devices Market is likely to benefit from this upward trend in healthcare investment.

Technological Innovations in Device Design

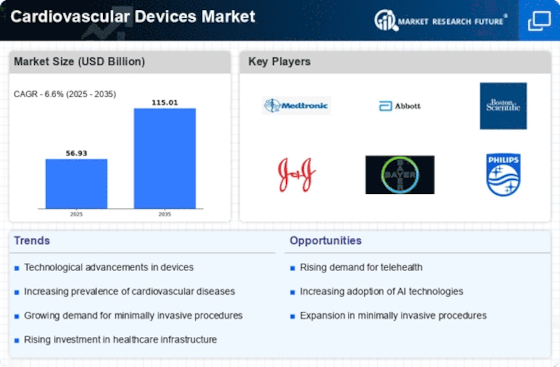

Technological advancements play a crucial role in shaping the Cardiovascular Devices Market. Innovations such as minimally invasive surgical techniques, advanced imaging technologies, and the integration of artificial intelligence are revolutionizing the design and functionality of cardiovascular devices. For instance, the introduction of bioresorbable stents has transformed treatment protocols, offering patients safer and more effective options. Moreover, the market is witnessing a surge in the development of wearable devices that monitor cardiovascular health in real-time, enhancing patient engagement and outcomes. As these technologies continue to evolve, they are expected to drive market growth, with projections indicating a compound annual growth rate of over 7% in the coming years. This trend underscores the importance of continuous research and development in the Cardiovascular Devices Market.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases is a primary driver for the Cardiovascular Devices Market. According to recent statistics, cardiovascular diseases account for a substantial portion of global mortality rates, with estimates suggesting that they are responsible for nearly 31% of all deaths. This alarming trend necessitates the development and deployment of advanced cardiovascular devices, including stents, pacemakers, and implantable defibrillators. As healthcare systems strive to address this growing burden, investments in innovative technologies are likely to surge, thereby propelling the market forward. Furthermore, the aging population, which is more susceptible to heart-related ailments, further exacerbates the demand for effective cardiovascular solutions. Consequently, the Cardiovascular Devices Market is poised for significant growth as stakeholders respond to these pressing health challenges.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are essential factors driving the Cardiovascular Devices Market. Governments and regulatory bodies are increasingly recognizing the importance of cardiovascular health, leading to streamlined approval processes for innovative devices. This regulatory environment encourages manufacturers to invest in research and development, resulting in a wider array of advanced cardiovascular solutions. Additionally, favorable reimbursement policies are incentivizing healthcare providers to adopt new technologies, as they can recover costs associated with the use of these devices. As reimbursement frameworks evolve to support the integration of cutting-edge cardiovascular technologies, the market is likely to witness accelerated growth. This supportive landscape is crucial for the continued advancement of the Cardiovascular Devices Market.

Rising Awareness and Education on Heart Health

The increasing awareness and education regarding heart health are pivotal drivers for the Cardiovascular Devices Market. Public health campaigns and initiatives aimed at promoting cardiovascular health have led to a more informed population, which is actively seeking preventive measures and treatment options. This heightened awareness is translating into greater demand for cardiovascular devices, as individuals recognize the importance of early detection and intervention. Furthermore, educational programs targeting healthcare professionals are enhancing the understanding of the latest advancements in cardiovascular technology, thereby fostering a more informed approach to patient care. As awareness continues to grow, the Cardiovascular Devices Market is expected to experience a corresponding increase in device adoption and utilization.