Growing Awareness of Heart Health

There is a notable increase in public awareness regarding heart health in Japan, which is positively impacting the cardiovascular devices market. Educational campaigns and health initiatives have led to a greater understanding of cardiovascular diseases and the importance of early intervention. As individuals become more proactive about their health, the demand for cardiovascular devices is expected to rise. This trend is further supported by the increasing availability of health screenings and check-ups, which encourage early detection of heart-related issues. Consequently, the cardiovascular devices market is likely to benefit from this heightened awareness, as more patients seek out advanced treatment options.

Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health are playing a crucial role in the cardiovascular devices market. The Japanese government has implemented various programs to promote research and development in medical technology, particularly in cardiovascular care. Funding for innovative projects and collaborations between public and private sectors is expected to increase, fostering advancements in device technology. Moreover, the government's focus on preventive healthcare may lead to higher demand for cardiovascular devices, as early detection and treatment become priorities. This supportive regulatory environment is likely to stimulate growth in the cardiovascular devices market, as manufacturers respond to the increasing need for effective solutions.

Aging Population and Healthcare Demand

Japan's aging population is a significant driver of the cardiovascular devices market. With over 28% of the population aged 65 and older, the demand for cardiovascular care is escalating. Older adults are more susceptible to cardiovascular diseases, necessitating the use of various medical devices for management and treatment. The healthcare system is under pressure to provide adequate services, leading to increased investments in cardiovascular technologies. Projections indicate that the cardiovascular devices market could expand by approximately 10% annually, reflecting the urgent need for innovative solutions to cater to this demographic. As the population continues to age, the market is expected to grow in response to the rising healthcare demands.

Technological Innovations in Device Design

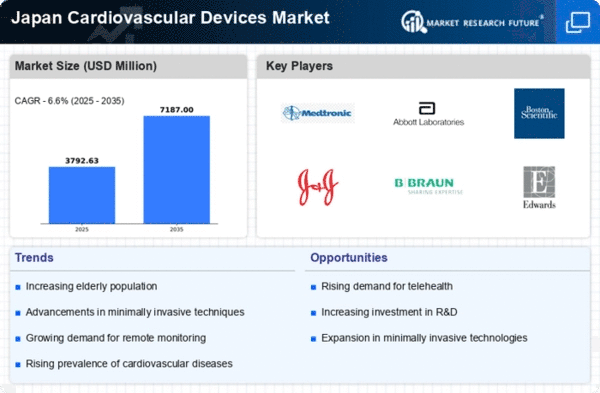

Innovations in technology are significantly influencing the cardiovascular devices market. The introduction of minimally invasive procedures and advanced imaging techniques has transformed the landscape of cardiovascular care in Japan. For instance, the development of bioresorbable stents and wearable heart monitors has improved patient comfort and outcomes. The market for cardiovascular devices is projected to grow at a CAGR of around 8% over the next five years, driven by these technological advancements. Additionally, the integration of artificial intelligence in device functionality is enhancing diagnostic accuracy and treatment efficacy. As healthcare providers increasingly adopt these innovations, the cardiovascular devices market is poised for robust expansion.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in Japan is a primary driver for the cardiovascular devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates the adoption of advanced cardiovascular devices for diagnosis and treatment. The demand for devices such as stents, pacemakers, and defibrillators is expected to rise as healthcare providers seek to improve patient outcomes. Furthermore, the Japanese government has been investing in healthcare infrastructure, which may enhance access to these devices. As a result, the cardiovascular devices market is likely to experience substantial growth, driven by the urgent need to address the rising burden of cardiovascular diseases.