Supportive Regulatory Environment

Italy's regulatory framework is increasingly supportive of the cardiovascular devices market, facilitating the approval and commercialization of new technologies. The Italian Medicines Agency (AIFA) has streamlined the approval process for medical devices, which may encourage manufacturers to introduce innovative products. This supportive environment is crucial for fostering competition and ensuring that healthcare providers have access to the latest advancements in cardiovascular care. As regulatory hurdles diminish, the cardiovascular devices market is expected to expand, providing patients with improved treatment options and enhancing overall healthcare outcomes.

Investment in Healthcare Infrastructure

Italy's commitment to enhancing its healthcare infrastructure significantly impacts the cardiovascular devices market. The government has allocated substantial funds to modernize hospitals and clinics, ensuring they are equipped with the latest medical technologies. This investment is projected to reach €5 billion by 2026, facilitating the acquisition of advanced cardiovascular devices. Improved healthcare facilities are essential for effective diagnosis and treatment of cardiovascular conditions, thereby driving demand for innovative devices. Additionally, the integration of telemedicine and digital health solutions within the infrastructure may further enhance the accessibility and efficiency of cardiovascular care, contributing positively to the market.

Growing Awareness of Preventive Healthcare

There is a notable increase in public awareness regarding preventive healthcare in Italy, which is influencing the cardiovascular devices market. Campaigns promoting heart health and regular screenings have led to a rise in early detection of cardiovascular issues. This shift towards preventive measures is likely to increase the demand for diagnostic devices such as echocardiograms and Holter monitors. As individuals become more proactive about their cardiovascular health, healthcare providers are expected to invest in advanced devices to meet this growing need. Consequently, the cardiovascular devices market may see a significant uptick in sales as preventive healthcare becomes a priority.

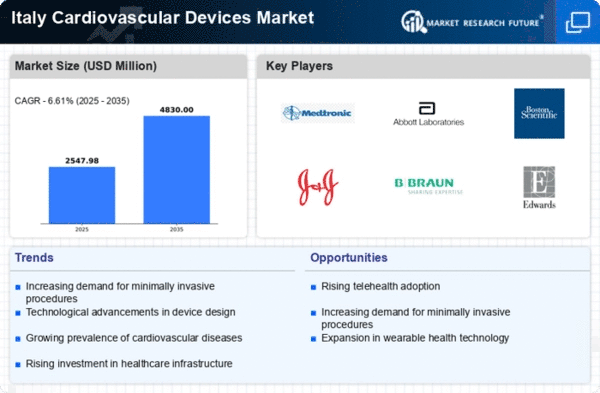

Technological Innovations in Device Design

The cardiovascular devices market is experiencing a surge in technological innovations that enhance device performance and patient outcomes. Recent advancements in materials science and engineering have led to the development of more durable and biocompatible devices. For instance, the introduction of drug-eluting stents has revolutionized the treatment of coronary artery disease, reducing the risk of restenosis. Furthermore, the integration of artificial intelligence in device functionality is expected to improve monitoring and treatment precision. As these innovations continue to emerge, they are likely to attract investment and drive growth within the cardiovascular devices market.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in Italy is a primary driver for the cardiovascular devices market. According to recent health statistics, cardiovascular diseases account for approximately 35% of all deaths in the country. This alarming trend necessitates the adoption of advanced cardiovascular devices for diagnosis and treatment. The demand for devices such as stents, pacemakers, and defibrillators is expected to rise as healthcare providers seek to improve patient outcomes. Furthermore, the Italian healthcare system is increasingly focusing on preventive measures, which may further boost the market. As the population becomes more aware of cardiovascular health, the cardiovascular devices market is likely to experience substantial growth.