Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health are playing a crucial role in the growth of the cardiovascular devices market. In France, various public health campaigns and funding programs are being implemented to promote awareness and prevention of cardiovascular diseases. The French government has allocated substantial resources to support research and development in medical technologies, including cardiovascular devices. This financial backing encourages innovation and facilitates the entry of new products into the market. As a result, the cardiovascular devices market is expected to benefit from increased investment in healthcare infrastructure and technology, ultimately leading to better patient care and outcomes.

Technological Innovations in Device Design

Technological advancements in device design are significantly influencing the cardiovascular devices market. Innovations such as minimally invasive procedures, advanced imaging techniques, and smart devices are transforming the landscape of cardiovascular care in France. For instance, the introduction of bioresorbable stents and wearable heart monitors has revolutionized patient monitoring and treatment options. The market is projected to grow at a CAGR of around 8% over the next five years, driven by these innovations. Furthermore, the integration of artificial intelligence and machine learning in device functionality is enhancing diagnostic accuracy and treatment efficacy. As healthcare providers adopt these cutting-edge technologies, the cardiovascular devices market is likely to expand rapidly.

Rising Incidence of Cardiovascular Diseases

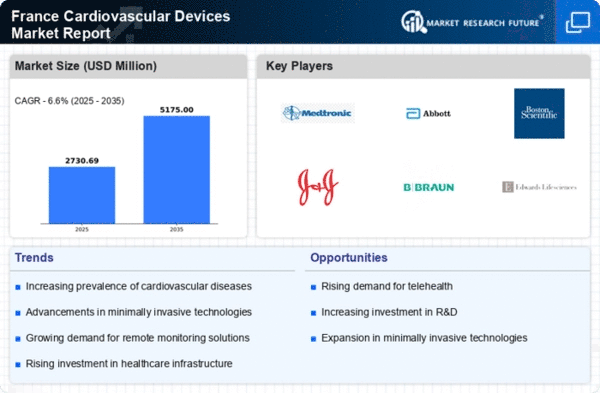

The increasing prevalence of cardiovascular diseases in France is a primary driver for the cardiovascular devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates the adoption of advanced cardiovascular devices for diagnosis, treatment, and management. The growing aging population, coupled with lifestyle factors such as obesity and sedentary behavior, further exacerbates this issue. As a result, healthcare providers are increasingly investing in innovative cardiovascular technologies to improve patient outcomes. The cardiovascular devices market is expected to witness substantial growth. Hospitals and clinics are seeking to enhance their capabilities in managing cardiovascular conditions effectively..

Growing Demand for Home Healthcare Solutions

The rising demand for home healthcare solutions is emerging as a significant driver for the cardiovascular devices market. With an increasing number of patients preferring to manage their health conditions at home, there is a growing need for portable and user-friendly cardiovascular devices. Products such as home blood pressure monitors and portable ECG devices are gaining popularity among patients and healthcare providers alike. This trend is likely to continue, as advancements in telemedicine and remote monitoring technologies facilitate better patient engagement and adherence to treatment plans. Consequently, the cardiovascular devices market is poised for growth as manufacturers respond to this demand by developing innovative home healthcare solutions.

Increased Investment in Research and Development

Investment in research and development (R&D) within the cardiovascular devices market is a critical driver of growth. In France, both public and private sectors are recognizing the importance of R&D in advancing cardiovascular care. Companies are allocating significant budgets to develop next-generation devices that offer improved performance and patient outcomes. This focus on innovation is expected to lead to the introduction of novel products, such as advanced stents and implantable devices with enhanced functionalities. As R&D efforts intensify, the cardiovascular devices market is likely to experience accelerated growth, driven by the continuous evolution of technology and the need for effective treatment options.