Increased Healthcare Expenditure

In Germany, increased healthcare expenditure is a significant driver of the cardiovascular devices market. The government and private sectors are investing heavily in healthcare infrastructure, which includes the procurement of advanced medical devices. In 2025, healthcare spending is expected to account for approximately 12% of the GDP, reflecting a commitment to improving health outcomes. This financial support facilitates the acquisition of cutting-edge cardiovascular devices, ensuring that healthcare providers have access to the latest technologies. Moreover, the emphasis on preventive care and early intervention strategies is likely to further boost the demand for cardiovascular devices. As healthcare budgets expand, the cardiovascular devices market is poised for robust growth, driven by the need for effective solutions to combat cardiovascular diseases.

Supportive Regulatory Environment

A supportive regulatory environment in Germany is instrumental in fostering the growth of the cardiovascular devices market. The regulatory framework ensures that medical devices meet stringent safety and efficacy standards, which builds trust among healthcare providers and patients. The European Medicines Agency (EMA) and the Federal Institute for Drugs and Medical Devices (BfArM) play crucial roles in overseeing the approval processes for new cardiovascular devices. In recent years, there has been a push for expedited approval pathways for innovative technologies, which may enhance market entry for new products. This regulatory support not only encourages manufacturers to invest in research and development but also facilitates quicker access to life-saving devices for patients. As a result, the cardiovascular devices market is likely to benefit from a favorable regulatory landscape that promotes innovation and ensures high-quality healthcare solutions.

Technological Innovations in Device Design

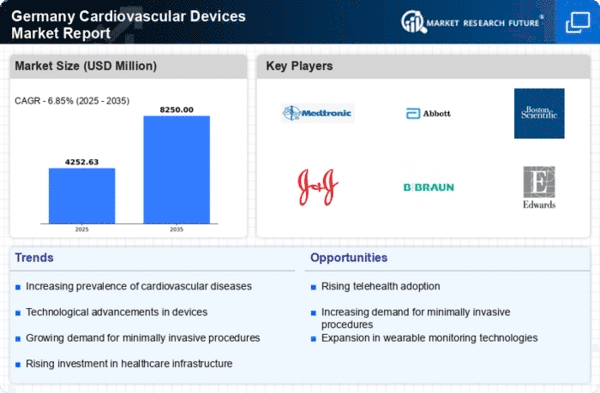

Technological innovations play a pivotal role in shaping the cardiovascular devices market. The introduction of minimally invasive procedures and advanced imaging techniques has revolutionized the treatment landscape. For instance, the development of bioresorbable stents and implantable devices has enhanced patient outcomes and reduced recovery times. In 2025, the market for innovative cardiovascular devices is projected to reach €3 billion, reflecting a compound annual growth rate (CAGR) of 8%. These advancements not only improve the efficacy of treatments but also attract investments from both public and private sectors, further stimulating market growth. As manufacturers continue to invest in research and development, the cardiovascular devices market is likely to witness a surge in novel products that cater to the evolving needs of healthcare providers and patients alike.

Rising Awareness and Education on Heart Health

Rising awareness and education regarding heart health significantly influence the cardiovascular devices market. Public health campaigns and educational initiatives have increased knowledge about cardiovascular diseases and their risk factors among the German population. This heightened awareness encourages individuals to seek regular check-ups and screenings, leading to early diagnosis and treatment. As a result, there is a growing demand for cardiovascular devices, such as diagnostic tools and therapeutic devices. In 2025, it is estimated that around 60% of the population will have undergone cardiovascular screenings, further driving the market. The emphasis on heart health education not only empowers patients but also fosters a proactive approach to managing cardiovascular conditions, thereby enhancing the overall growth of the cardiovascular devices market.

Aging Population and Rising Cardiovascular Diseases

The aging population in Germany is a critical driver for the cardiovascular devices market. As individuals age, the prevalence of cardiovascular diseases tends to increase, leading to a higher demand for medical interventions. According to recent statistics, approximately 40% of the elderly population in Germany suffers from some form of cardiovascular condition. This demographic shift necessitates the development and adoption of advanced cardiovascular devices, such as stents and pacemakers, to manage these health issues effectively. Furthermore, the increasing awareness of heart health among older adults is likely to propel market growth, as more individuals seek preventive measures and treatments. Consequently, the cardiovascular devices market is expected to expand significantly, driven by the urgent need to address the healthcare challenges posed by an aging society.