Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health significantly influence the cardiovascular devices market. The US government has implemented various programs to promote heart health, including funding for research and development of new medical technologies. The National Institutes of Health (NIH) allocates substantial resources to cardiovascular research, which fosters innovation in device development. Additionally, the Affordable Care Act has expanded access to preventive services, encouraging early detection and treatment of cardiovascular conditions. This increased focus on cardiovascular health is likely to stimulate market growth, as healthcare providers seek to adopt the latest devices to comply with regulatory standards and improve patient care. The infusion of public funding into cardiovascular research and device innovation is expected to enhance the overall landscape of the cardiovascular devices market.

Aging Population and Lifestyle Changes

The demographic shift towards an aging population in the US is a crucial factor driving the cardiovascular devices market. As individuals age, they become more susceptible to cardiovascular diseases, necessitating the use of advanced medical devices for diagnosis and treatment. Furthermore, lifestyle changes, including poor diet and lack of physical activity, contribute to the rising prevalence of heart-related conditions. The US Census Bureau projects that by 2030, approximately 20% of the population will be 65 years or older, creating a substantial demand for cardiovascular devices. This demographic trend, combined with the increasing awareness of heart health, is likely to propel market growth. Manufacturers are responding by developing innovative devices tailored to the needs of older patients, thereby enhancing the overall efficacy of cardiovascular care.

Technological Innovations in Device Design

Technological innovations play a pivotal role in shaping the cardiovascular devices market. The introduction of advanced materials, miniaturization of devices, and integration of smart technology are transforming the landscape of cardiovascular care. For instance, the development of bioresorbable stents and implantable devices equipped with remote monitoring capabilities is revolutionizing treatment options. These innovations not only improve patient outcomes but also enhance the efficiency of healthcare delivery. The market is witnessing a surge in demand for devices that offer real-time data analytics and connectivity, allowing healthcare providers to monitor patients remotely. As technology continues to evolve, the cardiovascular devices market is expected to expand, driven by the need for more effective and patient-centric solutions.

Rising Prevalence of Cardiovascular Diseases

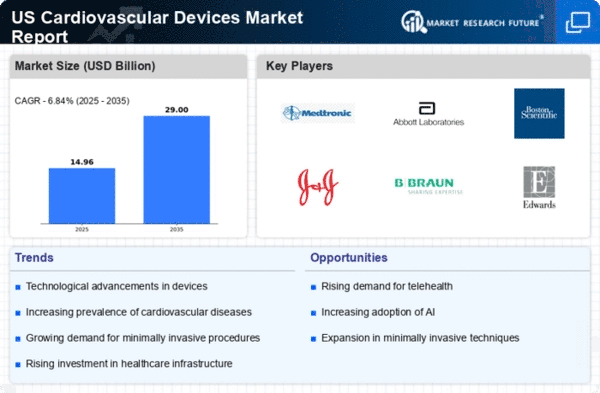

The increasing incidence of cardiovascular diseases in the US is a primary driver for the cardiovascular devices market. According to the CDC, heart disease remains the leading cause of death, accounting for approximately 697,000 deaths annually. This alarming statistic underscores the urgent need for effective diagnostic and therapeutic devices. As the population ages, the prevalence of conditions such as hypertension and coronary artery disease is expected to rise, further propelling demand for innovative cardiovascular devices. The market is projected to grow at a CAGR of around 5.5% through 2027, driven by advancements in device technology and an increasing focus on preventive healthcare. Consequently, healthcare providers are investing in state-of-the-art cardiovascular devices to enhance patient outcomes and reduce mortality rates associated with heart diseases.

Increasing Awareness and Education on Heart Health

The growing awareness and education surrounding heart health are significant drivers of the cardiovascular devices market. Public health campaigns and educational initiatives have heightened awareness of cardiovascular diseases and their risk factors. Organizations such as the American Heart Association actively promote heart health through various outreach programs, encouraging individuals to adopt healthier lifestyles. This increased awareness is likely to lead to higher demand for cardiovascular devices, as individuals seek preventive measures and treatment options. Moreover, healthcare providers are increasingly focusing on patient education, which empowers patients to make informed decisions regarding their cardiovascular health. As a result, the cardiovascular devices market is expected to benefit from this heightened awareness, leading to increased adoption of innovative devices.