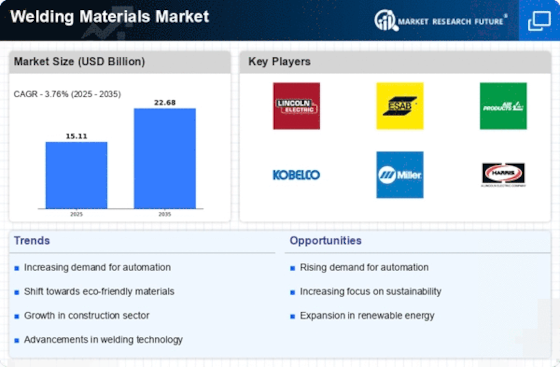

Focus on Renewable Energy Projects

The shift towards renewable energy sources is influencing the Welding Materials Market, as new projects in solar, wind, and hydroelectric power generation require specialized welding materials. The construction of renewable energy facilities necessitates high-quality welding to ensure structural integrity and longevity. In 2025, investments in renewable energy projects are expected to rise significantly, potentially increasing the demand for welding materials by approximately 6%. This trend reflects a broader commitment to sustainability and environmental responsibility, prompting manufacturers to develop materials that align with these values. As the renewable energy sector expands, the Welding Materials Market is likely to benefit from increased demand for innovative and eco-friendly welding solutions.

Rising Demand from Automotive Sector

The automotive industry is a significant driver of the Welding Materials Market, as manufacturers increasingly rely on welding for vehicle assembly and production. With the rise of electric vehicles and advancements in lightweight materials, the demand for specialized welding materials is expected to grow. In 2025, the automotive sector is projected to contribute a notable percentage to the overall welding materials consumption, with estimates indicating a growth rate of around 4% annually. This trend is fueled by the need for durable and efficient welding solutions that can accommodate the unique requirements of modern vehicle designs. As automotive manufacturers continue to innovate, the Welding Materials Market is likely to adapt, offering materials that meet stringent safety and performance standards.

Growth in Manufacturing and Heavy Industries

The resurgence of manufacturing and heavy industries is a key driver for the Welding Materials Market. As economies recover and industrial activities ramp up, the need for welding materials in sectors such as shipbuilding, aerospace, and heavy machinery is expected to rise. In 2025, the manufacturing sector is projected to account for a significant portion of the welding materials market, with growth rates estimated at around 5% annually. This increase is attributed to the ongoing modernization of manufacturing processes and the need for high-performance materials that can withstand demanding applications. As industries evolve, the Welding Materials Market is likely to adapt, providing innovative solutions that cater to the specific needs of various manufacturing sectors.

Technological Innovations in Welding Processes

Technological advancements are reshaping the Welding Materials Market, as new welding techniques and materials emerge. Innovations such as laser welding, friction stir welding, and advanced robotic welding systems are gaining traction, enhancing efficiency and precision in welding operations. These technologies not only improve the quality of welds but also reduce production costs, making them attractive to manufacturers. The integration of automation and artificial intelligence in welding processes is expected to further streamline operations, potentially increasing the demand for specialized welding materials. As companies adopt these cutting-edge technologies, the Welding Materials Market is likely to witness a shift towards high-performance materials that can withstand the rigors of modern applications.

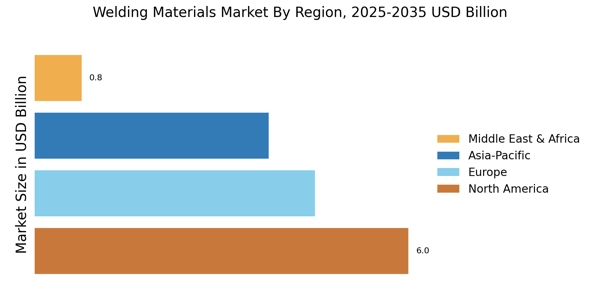

Increasing Demand for Construction and Infrastructure

The Welding Materials Market is experiencing a surge in demand driven by the ongoing expansion of construction and infrastructure projects. As urbanization accelerates, the need for robust welding materials to support structural integrity becomes paramount. In 2025, the construction sector is projected to account for a substantial share of the welding materials consumption, with estimates suggesting a growth rate of approximately 5% annually. This trend is particularly evident in regions where infrastructure development is prioritized, leading to increased investments in welding technologies and materials. Consequently, manufacturers are likely to innovate and enhance their product offerings to meet the evolving requirements of the construction industry, thereby propelling the Welding Materials Market forward.