Welding Materials Size

Welding Materials Market Growth Projections and Opportunities

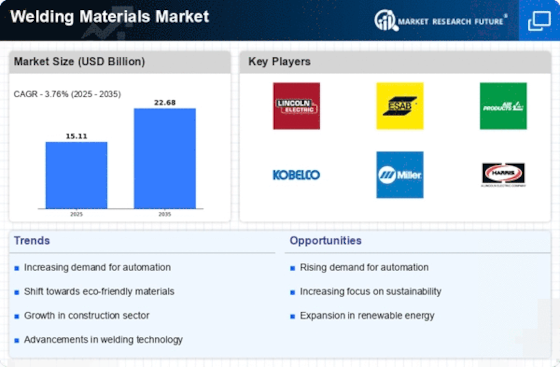

Many variables shape the Welding Materials Market's dynamics and growth. The rising need for welding materials in automotive, construction, and aerospace industries is a major driver. The need for welding materials including electrodes, filler metals, and shielding gases has increased as these sectors grow. Infrastructure projects require considerable welding, hence the construction industry drives the market.

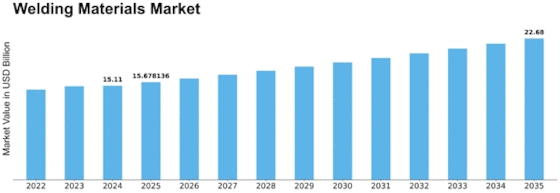

In 2022, welding materials market size was $13.9 billion. The welding materials market is expected to increase from USD 14.49 Billion in 2023 to USD 20.30 Billion in 2032, a CAGR of 4.30%.

The welding materials industry is also influenced by global economic conditions. Industrial activity rises with economic stability and expansion, raising welding material demand. Conversely, economic downturns can impede construction and production, hurting the market. Thus, industry players closely track global economic developments to predict demand adjustments.

Technology is another important market component. Advanced welding technologies have created better-performing materials. This involves using high-strength welding consumables and innovative welding methods to improve efficiency and quality. Companies that spend in R&D to keep ahead of technology frequently have a commercial advantage.

Recently, environmental rules and sustainability concerns have grown in importance. Eco-friendly welding materials and procedures are being used by industries due to strict environmental regulations worldwide. Demand for materials that reduce emissions, odors, and waste is rising. This trend is driving welding material makers to create sustainable materials that meet legal and environmental standards.

Competition also impacts the welding materials industry. Multiple market entrants encourage innovation and product enhancement. Competitive pricing, quality assurance, and effective distribution networks are essential in this competitive market. Strategic alliances and cooperation can also boost market players' potential and client base.

Geopolitics and trade policy affect welding materials sales. Tariffs, trade agreements, and geopolitics affect raw material, production, and distribution costs. Welding materials companies monitor geopolitical trends to adjust their plans and reduce trade risk.

The welding materials market evolves due to customer preferences and industrial needs. Different industries require different welding solutions based on their uses. The aircraft industry may favor lightweight materials with strict performance standards, whereas the car industry may require strong and corrosion-resistant materials. Welding materials producers must understand and meet these various needs to succeed.

Leave a Comment