Expansion of Renewable Energy Projects

The Arc Welding Equipment Market is benefiting from the expansion of renewable energy projects, particularly in solar and wind energy sectors. As countries invest in sustainable energy solutions, the demand for welding equipment that can withstand harsh environmental conditions is increasing. For instance, the installation of solar panels and wind turbines requires specialized robotics welding techniques to ensure durability and efficiency. Market analysts project that the renewable energy sector will grow at a compound annual growth rate of around 8% through 2025, which will subsequently drive demand for high-quality arc welding equipment. This trend indicates a promising opportunity for manufacturers within the Arc Welding Equipment Market to cater to the specific needs of the renewable energy sector.

Emerging Markets and Infrastructure Development

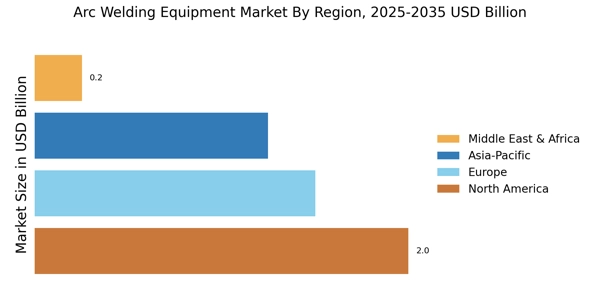

The Arc Welding Equipment Market is poised for growth due to the emergence of new markets and ongoing infrastructure development in various regions. Countries in Asia and Africa are investing heavily in infrastructure projects, which necessitate the use of advanced welding technologies. The demand for arc welding equipment is expected to rise as these regions develop their industrial capabilities. In 2025, it is anticipated that infrastructure spending in these emerging markets will increase by approximately 6%, creating a favorable environment for the Arc Welding Equipment Market. This growth presents opportunities for manufacturers to expand their reach and establish a presence in these developing regions, thereby enhancing their market share.

Growing Emphasis on Safety and Compliance Standards

In the Arc Welding Equipment Market, there is an increasing emphasis on safety and compliance with industry standards. As regulations become more stringent, manufacturers are compelled to invest in welding equipment that meets safety requirements and enhances worker protection. This trend is particularly evident in sectors such as construction and automotive, where the risks associated with welding operations are substantial. The market is responding to this demand by developing equipment that incorporates safety features, such as automatic shut-off systems and improved ventilation. Furthermore, compliance with international standards is becoming a prerequisite for market entry, thereby driving innovation in the Arc Welding Equipment Market. As a result, companies that prioritize safety and compliance are likely to gain a competitive edge.

Increased Adoption of Advanced Welding Technologies

The Arc Welding Equipment Market is witnessing a notable shift towards the adoption of advanced welding technologies, such as robotic welding and automated systems. These technologies offer enhanced precision, efficiency, and safety, which are critical in modern manufacturing environments. As industries strive to improve production rates and reduce operational costs, the integration of advanced welding solutions becomes imperative. Market data indicates that the segment of automated welding equipment is expected to grow by over 7% annually through 2025. This trend reflects a broader industry movement towards innovation, where companies are increasingly investing in state-of-the-art welding equipment to maintain competitive advantages. The Arc Welding Equipment Market is thus likely to see a significant uptick in demand for these advanced solutions.

Rising Demand in Construction and Manufacturing Sectors

The Arc Welding Equipment Market is experiencing a surge in demand, primarily driven by the robust growth in the construction and manufacturing sectors. As infrastructure projects expand and manufacturing processes become more complex, the need for efficient and reliable welding solutions intensifies. In 2025, the construction sector is projected to grow at a rate of approximately 5.5%, which directly correlates with increased investments in welding equipment. This growth is further supported by the rising trend of automation in manufacturing, where arc welding plays a crucial role in enhancing productivity and ensuring quality. Consequently, the Arc Welding Equipment Market is poised to benefit significantly from these developments, as companies seek advanced welding technologies to meet their operational demands.