Growth in Automotive Manufacturing

The automotive manufacturing sector in the US is undergoing a transformation, which seems to be positively influencing the welding shielding-gas market. With the rise of electric vehicles (EVs) and advancements in automotive technology, the demand for precise welding techniques is increasing. In 2025, the automotive industry is expected to invest over $100 billion in new technologies, which will likely require specialized welding processes that utilize shielding gases. This shift towards more sophisticated manufacturing processes indicates a growing reliance on high-quality welding shielding gases, thereby driving the market forward. The welding shielding-gas market must adapt to these changes by providing tailored solutions that cater to the specific requirements of automotive manufacturers.

Increased Focus on Safety Standards

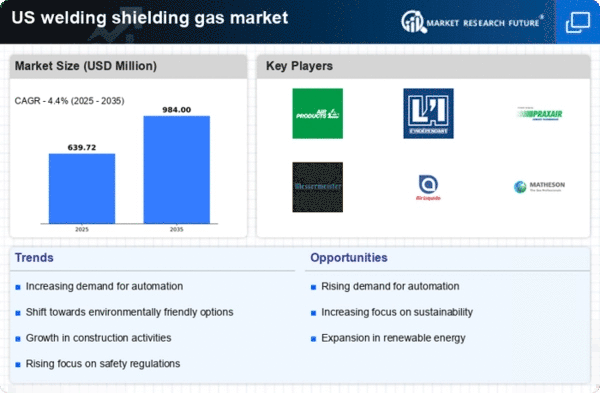

The welding shielding-gas market is experiencing a heightened emphasis on safety standards, which appears to be a significant driver of market growth. Regulatory bodies in the US are continuously updating safety protocols to ensure the well-being of workers in welding environments. As a result, companies are increasingly investing in high-quality shielding gases that minimize health risks associated with welding fumes. In 2025, it is anticipated that compliance with these safety regulations will lead to a 10% increase in the demand for premium shielding gases. This trend suggests that manufacturers must prioritize the development of safer and more efficient gas mixtures to meet the evolving safety requirements, thereby enhancing their market position.

Rising Demand in Construction Sector

The construction sector in the US is experiencing a notable resurgence, which appears to be a key driver for the welding shielding-gas market. As infrastructure projects gain momentum, the need for welding processes increases, thereby elevating the demand for shielding gases. In 2025, the construction industry is projected to grow by approximately 5% annually, leading to heightened activity in welding applications. This growth is likely to stimulate the consumption of various shielding gases, including argon and carbon dioxide, which are essential for ensuring high-quality welds. Consequently, the welding shielding-gas market is poised to benefit significantly from this trend, as manufacturers and suppliers align their offerings to meet the evolving needs of the construction sector.

Expansion of Renewable Energy Projects

The expansion of renewable energy projects in the US is likely to serve as a significant driver for the welding shielding-gas market. As the nation shifts towards sustainable energy sources, the construction of solar and wind energy facilities is increasing. These projects often require extensive welding applications, which in turn drives the demand for shielding gases. In 2025, investments in renewable energy are expected to exceed $50 billion, creating a substantial market for welding services. This trend suggests that the welding shielding-gas market must adapt to the unique requirements of renewable energy projects, potentially leading to the development of specialized gas mixtures that cater to this growing sector.

Technological Innovations in Welding Equipment

Technological innovations in welding equipment are emerging as a crucial driver for the welding shielding-gas market. The introduction of advanced welding machines that integrate sophisticated gas delivery systems is likely to enhance the efficiency and effectiveness of welding processes. In 2025, the market for welding equipment is projected to grow by 7%, which may lead to increased demand for compatible shielding gases. These innovations not only improve the quality of welds but also reduce gas consumption, thereby appealing to cost-conscious manufacturers. As the industry evolves, the welding shielding-gas market must keep pace with these technological advancements to remain competitive and meet the needs of modern welding applications.