Advancements in Sensor Technology

The Underwater Robotics Market is witnessing transformative advancements in sensor technology, which are crucial for enhancing the capabilities of underwater robots. Innovations in sonar, imaging, and environmental sensors are enabling these systems to operate more effectively in challenging underwater conditions. For instance, high-resolution imaging sensors allow for detailed mapping of underwater terrains, while advanced sonar systems improve navigation and obstacle detection. The market for underwater sensors is expected to grow significantly, with estimates suggesting a potential increase of over 20% in the next few years. These advancements not only improve the performance of underwater robotics but also expand their applications across various sectors, including environmental monitoring, oil and gas exploration, and marine archaeology. As sensor technology continues to evolve, the Underwater Robotics Market is likely to experience substantial growth.

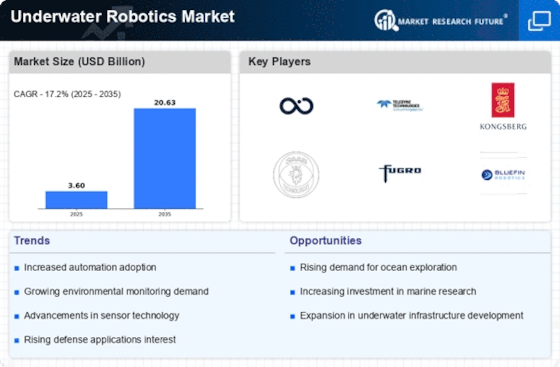

Growing Demand for Marine Exploration

The Underwater Robotics Market is experiencing a surge in demand for marine exploration technologies. As nations and organizations seek to understand oceanic ecosystems, the need for advanced underwater robotics has become paramount. These technologies facilitate deep-sea research, enabling scientists to gather data on marine biodiversity and geological formations. The market is projected to grow at a compound annual growth rate of approximately 15% over the next five years, driven by the increasing interest in oceanographic studies. Furthermore, the integration of artificial intelligence in underwater robotics enhances data collection and analysis, making these systems more efficient and effective. This growing demand for marine exploration is likely to propel the Underwater Robotics Market to new heights, as stakeholders invest in innovative solutions to address the challenges of underwater research.

Increased Focus on Environmental Monitoring

The Underwater Robotics Market is increasingly driven by a heightened focus on environmental monitoring and conservation efforts. As concerns about climate change and ocean health grow, there is a pressing need for technologies that can monitor underwater ecosystems effectively. Underwater robots equipped with specialized sensors can collect data on water quality, temperature, and marine life, providing valuable insights for researchers and policymakers. The market for environmental monitoring applications is projected to expand, with investments in underwater robotics aimed at supporting sustainable practices. This trend is likely to foster collaboration between governmental agencies, research institutions, and private companies, further propelling the Underwater Robotics Market. The integration of robotics in environmental monitoring not only enhances data collection but also aids in the development of strategies to protect marine environments.

Rising Applications in Defense and Security

The Underwater Robotics Market is significantly influenced by the rising applications of underwater robotics in defense and security sectors. Military organizations are increasingly adopting unmanned underwater vehicles (UUVs) for surveillance, reconnaissance, and mine detection operations. The global defense expenditure has seen a steady increase, with many countries allocating substantial budgets for advanced technologies, including underwater robotics. This trend is expected to continue, as the need for enhanced maritime security becomes more pressing. The Underwater Robotics Market is projected to benefit from this shift, with defense-related applications accounting for a considerable share of the market. The integration of sophisticated sensors and communication systems in these robotic platforms further enhances their operational capabilities, making them indispensable tools for modern naval operations.

Emerging Opportunities in Commercial Applications

The Underwater Robotics Market is poised for growth due to emerging opportunities in commercial applications. Industries such as oil and gas, aquaculture, and underwater construction are increasingly utilizing underwater robotics for various tasks, including inspection, maintenance, and data collection. The oil and gas sector, in particular, has seen a rise in the adoption of remotely operated vehicles (ROVs) for subsea operations, driven by the need for cost-effective and efficient solutions. Market analysts project that the commercial segment of the Underwater Robotics Market could witness a growth rate of around 12% in the coming years. This expansion is likely to be fueled by technological advancements and the increasing recognition of the benefits of underwater robotics in enhancing operational efficiency and safety across various industries.