North America : Market Leader in Innovation

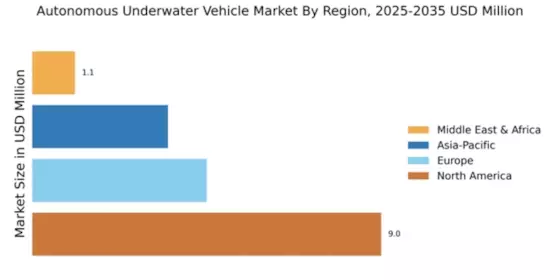

North America is poised to maintain its leadership in the Autonomous Underwater Vehicle (AUV) market, holding a significant share of 9.0 in 2025. The region's growth is driven by increasing investments in defense and marine research, alongside advancements in technology. Regulatory support from government agencies is fostering innovation, particularly in environmental monitoring and underwater exploration, which are critical for sustainable development.

The competitive landscape is robust, with key players like Teledyne Technologies, Lockheed Martin, and Boeing leading the charge. The U.S. remains the dominant force, leveraging its technological prowess and extensive funding for R&D. Canada is also emerging as a significant player, focusing on marine applications and environmental sustainability. This dynamic environment is expected to attract further investments, enhancing the region's market position.

Europe : Emerging Hub for AUVs

Europe is rapidly evolving as a key player in the Autonomous Underwater Vehicle (AUV) market, with a market size of 4.5 in 2025. The region benefits from strong governmental support for marine research and environmental protection initiatives, which are driving demand for AUVs. Regulatory frameworks are increasingly focused on sustainable practices, encouraging innovation in underwater technologies and applications.

Leading countries such as Norway, Germany, and the UK are at the forefront of this growth, with companies like Kongsberg Gruppen and Atlas Elektronik spearheading advancements. The competitive landscape is characterized by collaboration between private firms and governmental agencies, enhancing research capabilities. As Europe continues to invest in maritime security and environmental monitoring, the AUV market is expected to flourish.

Asia-Pacific : Rising Demand in Marine Applications

The Asia-Pacific region is witnessing a burgeoning demand for Autonomous Underwater Vehicles (AUVs), with a market size of 3.5 in 2025. This growth is fueled by increasing investments in marine research, defense, and offshore energy exploration. Countries are prioritizing technological advancements to enhance their maritime capabilities, supported by favorable government policies and funding initiatives aimed at boosting local industries.

Leading nations such as China, Japan, and Australia are driving the market forward, with significant contributions from companies like Fugro and ECA Group. The competitive landscape is marked by a mix of established players and emerging startups, all vying for a share of the growing market. As the region continues to focus on sustainable marine practices, the AUV market is set for substantial growth.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the Autonomous Underwater Vehicle (AUV) market, with a market size of 1.1 in 2025. The growth is primarily driven by the need for advanced technologies in resource exploration and environmental monitoring. Governments are increasingly recognizing the importance of AUVs for marine research and security, leading to supportive regulatory frameworks that encourage investment in this sector.

Countries like South Africa and the UAE are taking the lead in adopting AUV technologies, focusing on oil and gas exploration as well as marine conservation efforts. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region invests in technological advancements, the AUV market is expected to gain momentum.