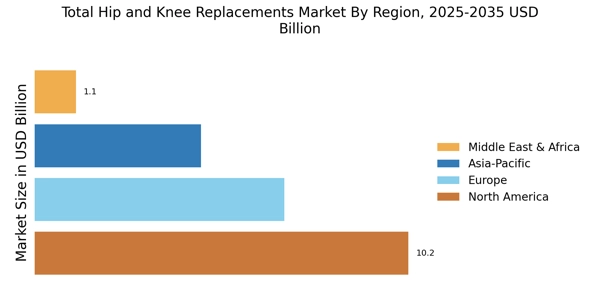

By Region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. The North American total hip and knee replacements market accounted for the largest market share in 2022. This is attributed to the rising number of hip arthroplasty and increasing strategic collaborations between major players and the rising geriatric population in the region. According to the American Joint Replacement Registry (AJRR), in 2019, around 1.5 million hip and knee arthroplasty surgeries were recorded in the registry. As a result, this promotes the market for total hip and knee replacements to grow.

Due to the increasing frequency of orthopedic diseases and the rapid adoption of novel products, the market for joint replacement is anticipated to grow in the region.

Further, the major countries studied are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: TOTAL HIP AND KNEE REPLACEMENTS MARKET BY REGION 2022 & 2030

Europe total hip and knee replacements market is expected to account for the second-largest market share due to the favorable health reimbursement, increased demand for customized implants, and an increased number of surgeries in the region. Further, the German market of total hip and knee replacements was attributed to holding the largest market share, and France market of total hip and knee replacements is expected to fastest-growing market in the European region.

The Asia-Pacific total hip and knee replacements market is expected to grow at the fastest rate from 2023 to 2030. This is due to the rising spending in healthcare, quickly evolving healthcare infrastructure, growing medical tourism, and increasing volume of hip replacement surgeries in the region. Moreover, China’s market of total hip and knee replacements is expected to hold the largest market share, and India market of total hip and knee replacements is expected fastest-growing market in the Asia-Pacific region.

Furthermore, according to The Asian Federation of Osteoporosis Societies (AFOS), there were 1.2 million hip fractures overall in 2019, and 2.6 million are anticipated by 2050. Over the next few years, it is anticipated that additional factors will affect the joint replacement market, including the ageing population, and rising healthcare spending in developing Asian economies in the market of total hip and knee replacements.

The Rest of the World includes the Middle East, Africa, and Latin America. The main factors influencing the growth of total hip and knee replacements in the Middle East and Africa are the rising number of orthopedic injuries & diseases and the rise in the adoption of implants, especially in the Middle East. Additionally, it is projected that factors such as the region's aging population, increased disposable income, and changing lifestyles will contribute to the market's expansion.