Rising Healthcare Expenditure

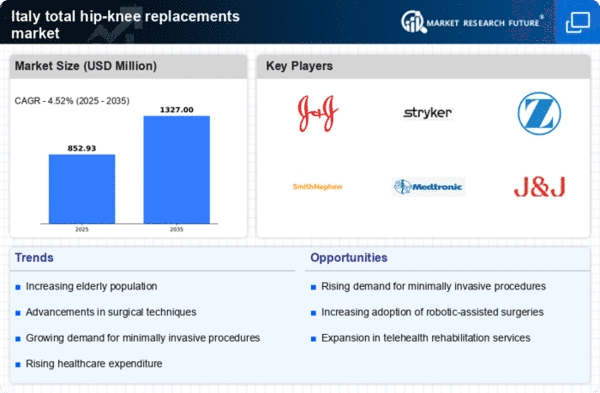

In Italy, rising healthcare expenditure is a crucial factor propelling the total hip-knee-replacements market. The Italian government has been increasing its healthcare budget, which is projected to reach approximately €200 billion by 2026. This increase allows for better funding of orthopedic procedures, including joint replacements. As healthcare facilities receive more resources, they can invest in advanced technologies and training for medical professionals, enhancing the quality of care provided. Moreover, with a growing focus on improving patient outcomes, hospitals are likely to prioritize joint replacement surgeries, further stimulating market growth. The total hip-knee-replacements market stands to benefit from this trend, as more patients gain access to necessary surgical interventions, leading to improved health outcomes and increased patient satisfaction.

Increased Focus on Quality of Life

The growing emphasis on quality of life among the Italian population is driving the total hip-knee-replacements market. Patients are increasingly seeking surgical options to alleviate pain and restore mobility, which is essential for maintaining an active lifestyle. This trend is particularly evident among older adults who wish to remain independent and engaged in social activities. As awareness of the benefits of joint replacement surgery rises, more individuals are likely to pursue these procedures. Additionally, healthcare providers are recognizing the importance of patient-centered care, which prioritizes the needs and preferences of patients. This shift in focus may lead to an increase in the number of total hip-knee-replacements performed, as patients are encouraged to consider surgical options that can significantly enhance their quality of life.

Advancements in Surgical Techniques

Innovations in surgical techniques are significantly influencing the total hip-knee-replacements market. Minimally invasive procedures, such as arthroscopy, have gained traction in Italy, allowing for quicker recovery times and reduced hospital stays. These advancements not only enhance patient outcomes but also lower the overall costs associated with joint replacement surgeries. For instance, studies indicate that minimally invasive hip replacements can reduce recovery time by up to 50%, which is appealing to both patients and healthcare providers. As these techniques become more widely adopted, the total hip-knee-replacements market is likely to see an increase in procedures performed annually. Furthermore, the integration of robotic-assisted surgery is emerging, which may further refine surgical precision and improve patient satisfaction, thereby driving market growth.

Aging Population and Increased Demand

The aging population in Italy is a primary driver for the total hip-knee-replacements market. As the demographic shifts towards an older age group, the incidence of osteoarthritis and other degenerative joint diseases rises. According to recent statistics, approximately 23% of the Italian population is aged 65 and older, which correlates with a higher demand for joint replacement surgeries. This demographic trend suggests that healthcare providers will likely experience increased pressure to meet the needs of older patients seeking relief from chronic pain and mobility issues. Consequently, The total hip-knee-replacements market is expected to expand. This expansion is due to more individuals requiring surgical interventions to maintain their quality of life. The healthcare system may need to adapt to accommodate this growing demand, potentially leading to innovations in surgical techniques and post-operative care.

Technological Integration in Healthcare

The integration of technology in healthcare is transforming the total hip-knee-replacements market in Italy. Digital health solutions, such as telemedicine and electronic health records, are streamlining patient management and improving surgical planning. These technologies facilitate better communication between patients and healthcare providers, ensuring that individuals receive timely information regarding their treatment options. Furthermore, the use of 3D printing in creating customized implants is gaining traction, allowing for more personalized surgical solutions. As these technological advancements continue to evolve, they are likely to enhance the efficiency and effectiveness of joint replacement surgeries. Consequently, the total hip-knee-replacements market may experience growth as healthcare providers adopt these innovations to improve patient outcomes and operational efficiency.