Government Initiatives and Healthcare Funding

Government initiatives and increased healthcare funding play a crucial role in the total hip-knee-replacements market. In France, the government has implemented various policies aimed at improving access to orthopedic surgeries, including hip and knee replacements. The national health insurance system covers a significant portion of the costs associated with these procedures, making them more accessible to patients. Additionally, funding for healthcare facilities has been on the rise, allowing hospitals to invest in advanced surgical technologies and training for medical staff. This support is likely to enhance the capacity of healthcare systems to meet the growing demand for joint replacement surgeries, thereby positively impacting the total hip-knee-replacements market.

Rising Awareness and Education on Joint Health

There is a growing awareness and education regarding joint health among the French population, which is influencing the total hip-knee-replacements market. Public health campaigns and educational programs are increasingly informing individuals about the benefits of early intervention for joint disorders. As a result, more patients are seeking medical advice and treatment options sooner, leading to an uptick in elective surgeries. Surveys indicate that nearly 60% of individuals aged 50 and above are now aware of the surgical options available for joint issues. This heightened awareness is expected to drive demand for hip and knee replacements, as patients become more proactive in managing their joint health.

Advancements in Surgical Techniques and Materials

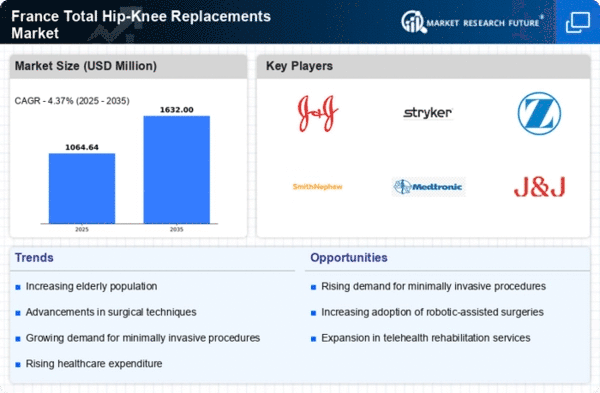

Innovations in surgical techniques and materials are transforming the total hip-knee-replacements market. The introduction of new implant materials, such as highly cross-linked polyethylene and titanium alloys, enhances the longevity and performance of joint replacements. Furthermore, minimally invasive surgical techniques are gaining traction, reducing recovery times and improving patient outcomes. In France, hospitals are increasingly adopting robotic-assisted surgeries, which can lead to more precise implant placements. This trend is reflected in the rising number of procedures performed, with estimates suggesting a growth of 5% annually in the total hip-knee-replacements market. These advancements not only improve surgical success rates but also contribute to patient satisfaction, driving further demand.

Increasing Prevalence of Obesity and Lifestyle Diseases

The rising prevalence of obesity and lifestyle-related diseases in France is a significant driver for the total hip-knee-replacements market. Obesity is a known risk factor for joint disorders, particularly osteoarthritis, which can lead to the need for surgical intervention. Current statistics suggest that approximately 30% of the adult population in France is classified as obese, contributing to an increased incidence of joint pain and mobility issues. As healthcare providers address the challenges posed by obesity, the demand for hip and knee replacements is likely to rise. This trend underscores the importance of addressing lifestyle factors in the management of joint health, further propelling the total hip-knee-replacements market.

Aging Population and Rising Incidence of Joint Disorders

The aging population in France is a primary driver for the total hip-knee-replacements market. As individuals age, the prevalence of joint disorders such as osteoarthritis increases significantly. Data indicates that approximately 30% of the population aged 65 and older experiences some form of arthritis, leading to a higher demand for hip and knee replacement surgeries. This demographic shift is expected to continue, with projections suggesting that by 2030, nearly 25% of the French population will be over 65 years old. Consequently, The total hip-knee-replacements market is likely to expand as healthcare providers address the growing need for surgical interventions. This will improve mobility and quality of life for older adults..