Advancements in Drug Development and Research

Innovations in drug development are significantly influencing the Osteoporosis Drugs Market. Recent advancements in biotechnology and pharmacology have led to the emergence of novel therapeutic agents, including biologics and targeted therapies. These new treatments are designed to enhance bone density and reduce fracture risk more effectively than traditional options. For instance, the introduction of monoclonal antibodies has shown promising results in clinical trials, indicating a potential shift in treatment paradigms. The ongoing research into the mechanisms of bone metabolism is likely to yield further breakthroughs, thereby expanding the range of available therapies. As a result, the Osteoporosis Drugs Market is poised for growth, driven by the introduction of more effective and safer treatment options that cater to the diverse needs of patients.

Regulatory Support and Approval of New Therapies

The Osteoporosis Drugs Market is experiencing favorable conditions due to regulatory support for the approval of new therapies. Regulatory agencies are increasingly recognizing the need for innovative treatments to address the growing burden of osteoporosis. Streamlined approval processes and incentives for the development of novel drugs are encouraging pharmaceutical companies to invest in research and development. This regulatory environment is likely to expedite the introduction of new therapies into the market, providing patients with more options for managing osteoporosis. As new drugs receive approval, the Osteoporosis Drugs Market is expected to witness a surge in product offerings, catering to the diverse needs of patients and healthcare providers alike.

Increased Awareness and Education on Osteoporosis

The Osteoporosis Drugs Market is also being propelled by heightened awareness and education regarding osteoporosis. Public health campaigns and educational initiatives are informing individuals about the risks associated with osteoporosis and the importance of early diagnosis and treatment. This increased awareness is leading to more individuals seeking medical consultations and preventive care, which in turn drives demand for osteoporosis drugs. Furthermore, healthcare professionals are becoming more proactive in screening and diagnosing osteoporosis, contributing to a larger patient population requiring treatment. The emphasis on preventive care and early intervention is likely to foster a more informed public, ultimately benefiting the Osteoporosis Drugs Market as more patients are treated effectively and efficiently.

Aging Population and Increased Incidence of Osteoporosis

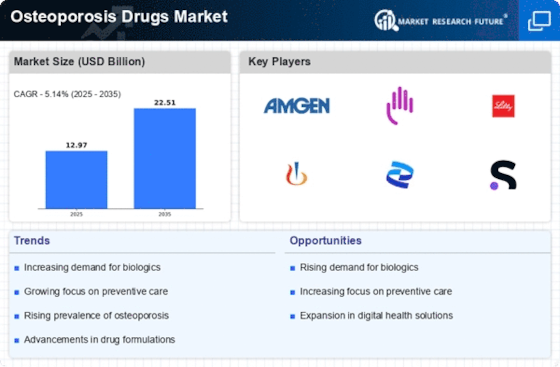

The Osteoporosis Drugs Market is experiencing a notable surge due to the aging population, which is increasingly susceptible to osteoporosis. As individuals age, bone density diminishes, leading to a higher prevalence of fractures and related complications. According to recent estimates, approximately 200 million people worldwide are affected by osteoporosis, with the majority being postmenopausal women. This demographic shift is likely to drive demand for osteoporosis drugs, as healthcare systems seek effective treatments to manage this condition. Furthermore, the increasing awareness of osteoporosis and its consequences is prompting more individuals to seek medical advice, thereby expanding the market for osteoporosis drugs. The growing incidence of osteoporosis among older adults suggests a sustained need for innovative therapies and preventive measures within the Osteoporosis Drugs Market.

Rising Healthcare Expenditure and Investment in Pharmaceuticals

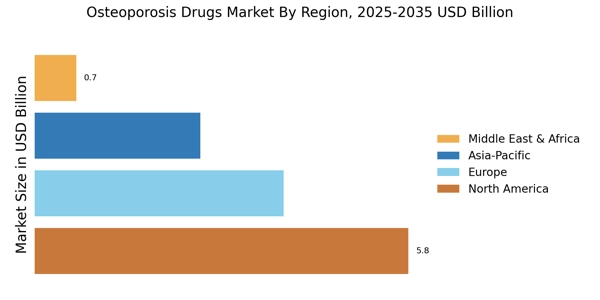

The Osteoporosis Drugs Market is benefiting from the increasing healthcare expenditure observed in various regions. Governments and private sectors are investing more in healthcare infrastructure, which includes funding for research and development in pharmaceuticals. This trend is particularly evident in countries with aging populations, where the burden of osteoporosis is more pronounced. The World Health Organization has reported that healthcare spending is projected to rise significantly, which could facilitate the development and accessibility of osteoporosis drugs. Additionally, the growing emphasis on improving patient outcomes is likely to drive investments in innovative therapies. As healthcare systems allocate more resources to combat osteoporosis, the Osteoporosis Drugs Market is expected to expand, providing patients with better treatment options and improving overall health outcomes.